(Bloomberg) – The ripple effects of President Donald Trump’s pro-crypto agenda have driven a surge in Bitcoin demand in Japan. There, pivots for one hotelier to stockpile cryptocurrency offers shareholders eye-catching returns.

Most of them read from Bloomberg

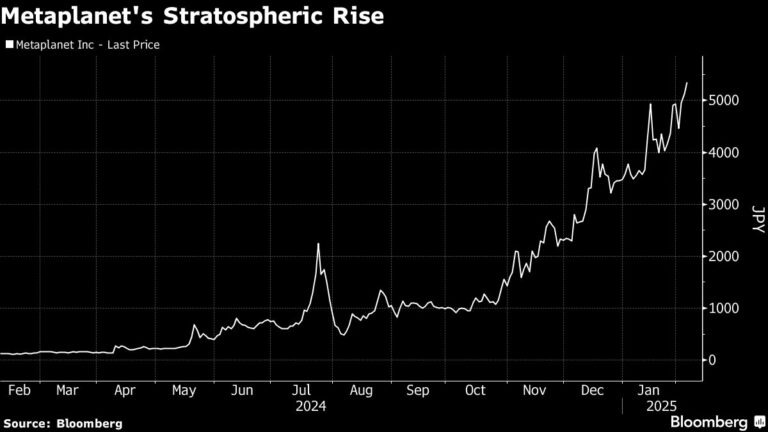

According to data compiled by Bloomberg, Metaplanet Inc. stock has grown by around 4,800% over the past 12 months, making it the largest profit of all Japanese stocks in that period and the highest in the world. Bitcoin itself hit a record high of $109,241 on January 20, as Trump was sworn in for his second term on January 20, but since then, trade policy has been experiencing global instability. They incited them, and they erased those benefits.

Metaplanet is one of many costumes around the world that aims to emulate the success of Michael Saylor’s strategy, formerly known as Micro Strategy Co., Ltd. 1 billion tokens.

Simon Jerovich, a former Goldman Sachs equity derivatives trader and CEO of Metaplanet, said he was drawn to the idea after hearing about Saylor’s strategy on the podcast. He ran Metaplanet, a former Red Planet Japan Inc. as a hotel developer since 2013, but in early 2024, he forced the pandemic to shutter everything except hotels. We have moved to the “Bitcoin First Strategy.”

Since then, Metaplanet shareholders have grown to almost 50,000, and by 2024 it has increased by 500%. Shareholders include capital groups that also invest in strategies, but the majority are retail investors, many of whom have limited experience with volatile crypto assets.

“Metaplanet has a very high exposure to volatile retail bases,” said Rhiannon Ewart-White, Japanese equity analyst and managing director of UK-based Storm Research. It’s there. “They need to make sure that shareholders understand exactly what their strategy is.”

After six consecutive years of losses, the company reported operating profit of 350 million yen ($2.3 million) for the year ended December 2024 on Monday. The results could further strengthen Metaplanet’s inventory, Ewart-White said.

Jerovic, who attended Trump’s inauguration in Washington last month, told Bloomberg in an interview that “excitement about a more Bitcoin-friendly regulatory environment” in the US has driven demand for tokens in Japan.

The story continues

The company is not Japan’s only micro-strategy copicat. For example, software developer RemixPoint Inc. announced plans to buy 1.2 billion yen in Bitcoin in September last year, and since then the stock price has risen by more than 300%.

The majority of Metaplanet’s retail shareholders have purchased shares through the Nippon Personal Savings Account (NISA) program. This was revamped by the Japanese government in early 2024 to encourage the Japanese government to invest savings for long-term growth and retirement.

Getto Hagiya, an 18-year-old robotics student from Tokyo, bought Metaplanet shares as his first investment under the tax-free program. He was thrilled with Bitcoin after hearing Trump promoted crypto-friendly policies during his campaign.

“I believe Bitcoin will become an essential asset in the future,” he said. Hagiya was seduced at the shareholders meeting to invest more by Metaplanet’s promise of free Bitcoin products.

Capital gains for direct Bitcoin purchases are subject to taxes of up to 55% in Japan and are an inexpensive and convenient option for small and first-time buyers, investing in stock proxies such as Metaplanet via NISA. .

Australian native Jerovic said he believes that “ongoing yen depreciation” is also a ripe market for Bitcoin as many investors are seeking “hedge against financial decline.”

Metaplanet holds 1,762 Bitcoins (currently worth around $172 million) as of January 28, according to the company’s presentation, and by the end of the following year, Metaplanet holds 1,762 Bitcoins (currently worth around $172 million) by the end of the following year, by the end of 2025. I plan to increase it to. To fund these purchases, the company aims to issue 21 million shares via a mobile strike warrant.

It will also be rebranding Royal Oak, the only remaining hotel in Tokyo’s Gotanda area, as a “Bitcoin Hotel” later this year, with the aim of hosting Bitcoin-related seminars and events.

Metaplanet has a “very small” hotel business following Bitcoin purchases and a “profitable” hotel business, says Ewart-White of Storm Research. Still, “the price of Bitcoin tanks would be very difficult for them,” she said.

Bitcoin was trading in London at $98,244 as of 9am on Tuesday.

– Support from Muyao Shen.

(Revenue results, charts, and Bitcoin prices updated)

Most of them read from Bloomberg BusinessWeek

©2025 Bloomberg LP