The NIFTY IT index, which hit a lifetime high last week, fell 4.8% in five sessions. BSE-listed companies have lost around Rs 17,000 crore in market capitalization this week. The Nifty Pharma index rose 1.6% this week.

Here’s another quick recap of this week’s markets, which featured bloodshed on Dalal Street.

The stock market, which witnessed four consecutive weeks of gains, suffered a severe shock this week. Five consecutive sessions of losses from December 16 to December 20 wiped out nearly Rs 17 billion of investors’ money this week.

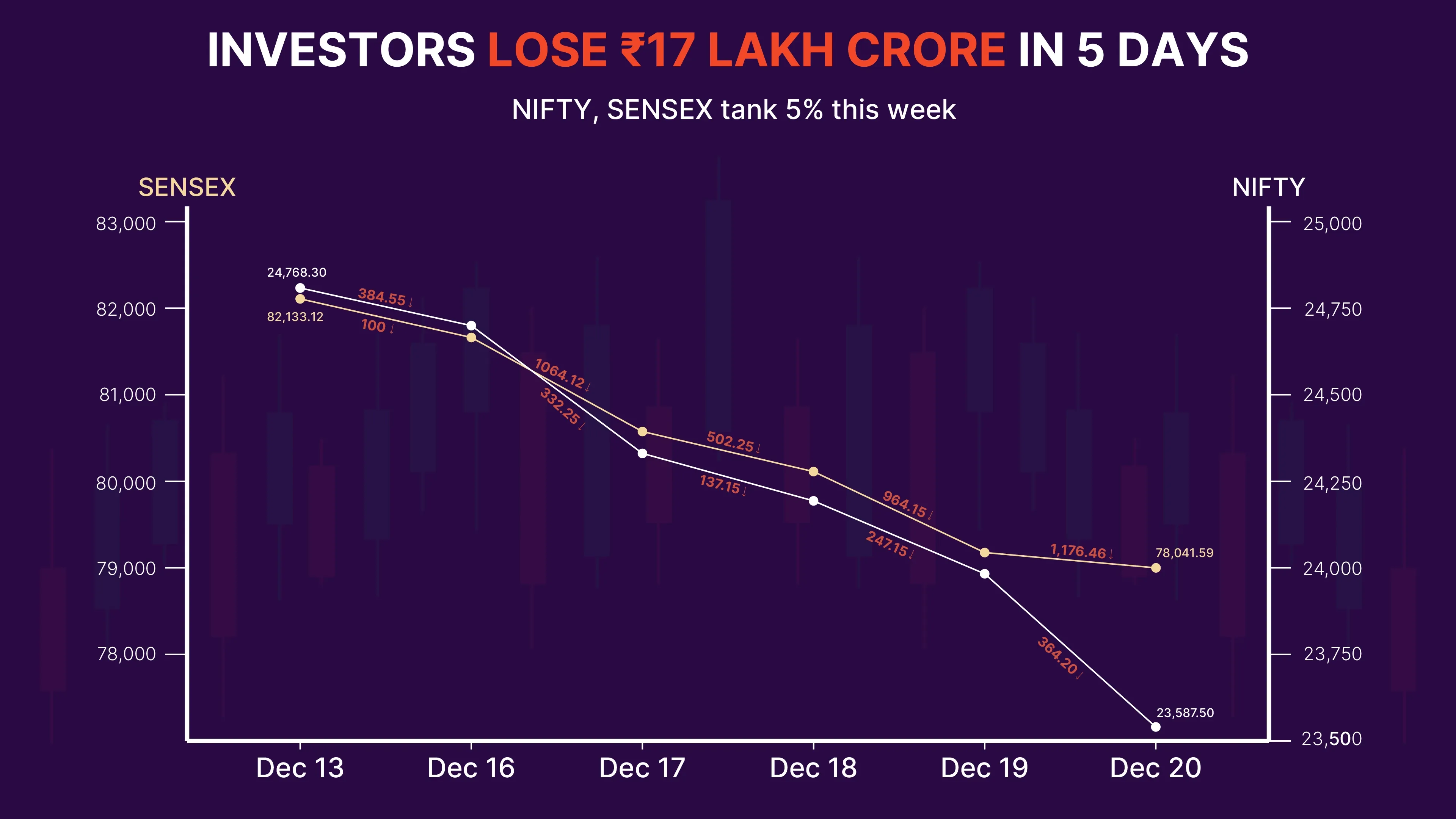

Looking at the weekly charts felt like watching SENSEX or NIFTY rolling down a hill. The benchmark index fell for the day, dropping 5%, its biggest weekly decline in two years.

During the week ending December 20, SENSEX fell 4,091 points (4.98%) to 78,041.59. Meanwhile, the NIFTY 50 index declined by 4.8% (1,181 points) during the same period to trade at 23,587.5.

The adjustment in the first half of the week is thought to be due to cautious trading by nervous investors ahead of the US Federal Reserve’s decision on policy interest rates. Markets had been pricing in a 25 basis point (bp) rate cut by the U.S. Federal Reserve, but investors became cautious over concerns about hawkish signals.

And that’s exactly what happened on Wednesday, when the Fed cut rates as expected but signaled there may only be two more rate cuts in 2025 instead of the four originally expected.

This triggered a new selloff that hit stocks around the world. Following the Fed’s policy results, SENSEX and NIFTY were caught in the vortex, falling 2.7% and 2.5% respectively in the next two sessions.

The Bank of Japan and the People’s Bank of China also left their benchmark lending rates unchanged as expected, with no positive surprises.

IT stocks

Information technology (IT) stocks were the biggest victims of this week’s correction. The NIFTY IT index, which made headlines last week after hitting a new lifetime high, has fallen in four out of five sessions, taking the cumulative decline of 4.8% during the period.

Surprisingly, IT stocks fell even as the Indian rupee hit a lifetime low of 85.07 to the US dollar. That’s a big plus for technology companies that make money in U.S. currency.

Experts say tech investors are pessimistic about the prospect of higher-than-expected U.S. interest rates next year. This could slow economic growth and limit discretionary IT spending by U.S. companies.

pharmaceutical stocks

Amid market turmoil, the pharmaceutical sector endured negative momentum this week. The weaker rupee is good news for Indian drug makers selling their products in the US market, with the Nifty Pharma index rising 1.6% this week.

MobiKwik stock doubles within 3 days of listing

What lies ahead?

Although the possibility of further correction cannot be ruled out, analysts say the market is expected to pull back next week as stocks appear oversold. This could lead to the “Santa Rally” that investors look forward to every holiday season.