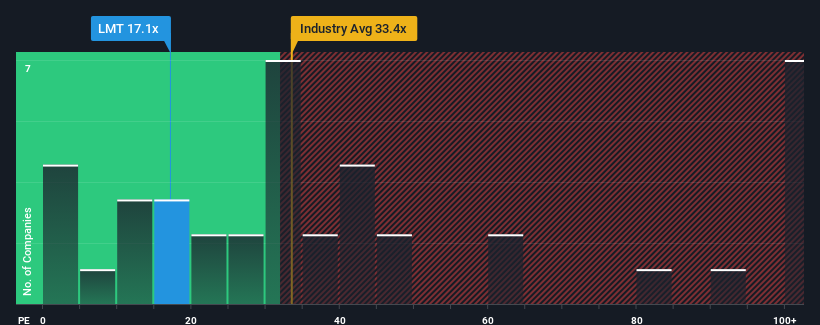

Lockheed Martin Corp. (NYSE:LMT) currently has a price-to-earnings ratio (PER) of 17.1x, which is fair to say that it’s fairly “middling” when compared to global markets. The median P/E ratio in the US is approximately 18x. This may not raise any eyebrows, but if the P/E ratio is not justified, investors may miss out on potential opportunities or ignore impending disappointment.

Lockheed Martin’s recent earnings growth has been in line with the market. Many believe that the company’s poor performance will continue, which is pushing down the P/E ratio. If you like the company, you’ll at least hope that this situation holds true and that you can buy stock while it’s not in good shape.

Check out our latest analysis for Lockheed Martin.

Want a complete picture of what analysts are predicting for the company? Our free report on Lockheed Martin can help you uncover what’s next.

Is there growth at Lockheed Martin?

For a P/E ratio like Lockheed Martin’s to be considered reasonable, there is an inherent assumption that a company needs to have a P/E ratio that is in line with the market.

Looking back, last year we had virtually the same revenue as the year before. In any case, the growth in the previous quarter allowed EPS to rise by a total of 29% compared to three years ago. Therefore, shareholders would not have been too happy with the unstable medium-term growth rate.

Turning to the outlook, analysts following the company estimate that the next three years should deliver annualized growth of 4.1%. The company’s earnings are expected to be weak as the market is expected to grow 11% annually.

With this information, we find it interesting that Lockheed Martin is trading at a P/E ratio that is roughly in line with the market. Most investors seem to be willing to pay for exposure to the stock, ignoring fairly limited growth expectations. It will be difficult to sustain this price, as this level of earnings growth is likely to eventually weigh on the stock price.

What can we learn from Lockheed Martin’s PER?

It has been argued that the price-to-earnings ratio is a poor measure of value in certain industries, but can be a powerful indicator of business confidence.

A review of analyst forecasts for Lockheed Martin reveals that the company’s poor earnings outlook hasn’t had as much of an impact on the company’s P/E ratio as expected. Looking at the weak earnings outlook, which is below market growth, we think there is a risk that the stock price will decline, leading to a moderate P/E decline. Unless this situation improves, it is difficult to accept this price as reasonable.

There are other important risk factors to consider before investing, and we’ve spotted 1 warning sign for Lockheed Martin you should be aware of.

If these risks should make you reconsider your opinion about Lockheed Martin, check out our interactive list of quality stocks to see what else is out there.

New feature: AI stock screener and alerts

Our new AI Stock Screener scans the market for opportunities every day.

• Dividend powerhouse (yield 3% or more)

• Small-cap stocks that are undervalued due to insider purchases.

• High-growth technology and AI companies

Or build your own metrics from over 50 metrics.

Explore for free now

Do you have feedback on this article? Interested in its content? Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.