Important points

Hyperscalers are accelerating capital spending budgets for artificial intelligence (AI).

Growing AI workloads are driving unprecedented demand for high-bandwidth memory chips.

SanDisk solid state drive and NAND flash memory solutions can help meet that demand.

10 stocks we like better than SanDisk ›

Since the commercial launch of ChatGPT on November 30, 2022, semiconductor giant Nvidia’s stock price has risen. (NASDAQ:NVDA) It has rapidly increased by over 1,000%. The artificial intelligence (AI) revolution has created an unprecedented wave of demand for Nvidia’s graphics processing units (GPUs), the hardware backbone on which AI models are trained.

Nvidia remains the king of the AI space, but increased infrastructure spending is a big tailwind for another type of AI chip: memory and storage. Let’s take a closer look at how SanDisk works (NASDAQ:SNDK) is quietly disrupting this part of the AI industry and assessing whether the company is on the verge of having an “Nvidia moment.”

Will AI create the world’s first millionaire? Our team published a report on one little-known company called an “essential monopoly” that provides critical technology needed by both Nvidia and Intel. Continued “

Image source: Getty Images.

SanDisk pivots from flash drives to AI data centers

In the early 2000s, SanDisk dominated the flash memory market, and its chips were commonly used in digital cameras, game consoles, and other consumer electronics. This is similar to Nvidia’s early origins, as the company’s GPUs were initially focused on enhancing the visuals of online games.

But developers have discovered that Nvidia’s chip architecture is ubiquitous, reusing this hardware to train and infer AI models. SanDisk is currently undergoing a similar evolution, with enterprise solid-state drive (SSD) and NAND flash memory services becoming essential components of hyperscalar data center stacks.

Can SanDisk become the Nvidia of AI memory storage?

One of the reasons Nvidia has become so dominant so quickly is due to the company’s first-mover advantage in GPU design. Advanced Micro Devices is just starting to raise the stakes in the GPU space. SanDisk is in a similar position. The memory storage market is highly fragmented, with other major players being Micron Technology, Samsung, and SK Hynix.

The total addressable market (TAM) for high-bandwidth memory (HBM) was estimated at $35 billion last year. Micron management expects the market to grow at a compound annual growth rate of 40% over the next few years, reaching $100 billion by 2028.

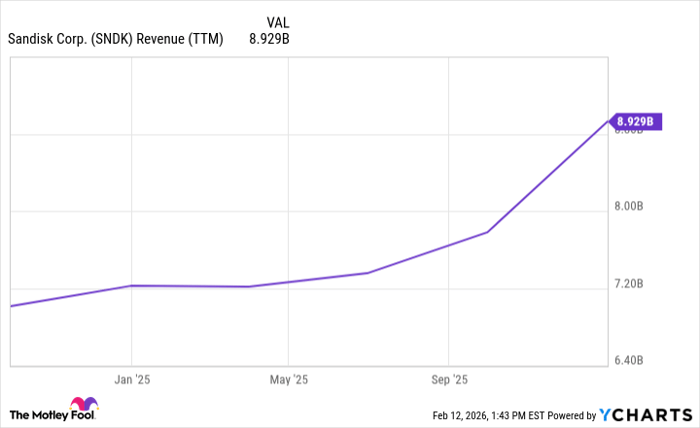

Given that SanDisk generated just $9 billion in revenue over the past year, the company has only scratched the surface of its growth potential relative to the size of the rapidly expanding AI memory market. Given the limited competitive dynamics and SanDisk’s accelerating sales, I think the company is in the early stages of following a similar trajectory to Nvidia in the early days of the AI boom.

SNDK Revenue (TTM) Data by YCharts

SanDisk is the ultimate AI infrastructure stock

This year, the Magnificent Seven companies plan to spend $680 billion on capital expenditures (Capex). Don’t get me wrong. Hyperscalers will continue to buy GPUs from Nvidia and AMD as both designers release new architectures this year. Additionally, major technology companies are also investing heavily in custom application-specific integrated circuits (ASICs) with support from Broadcom.

Beneath the surface, the demand Nvidia, AMD, and Broadcom are seeing will flow into downstream memory markets. Beyond chatbots, hyperscalers are exploring more advanced products across robotics, autonomous systems, and agent AI.

As AI workloads grow, capacity isn’t the only bottleneck. Rather, as spending on AI infrastructure accelerates, demand for memory storage solutions should increase parabolically. These long-term dynamics currently make SanDisk a great pickings for growth investors.

SanDisk is a solid buy as it plans to grow alongside other chips through the AI infrastructure era. If you think about it that way, I think SanDisk can be considered the “new NVIDIA.”

Should you buy SanDisk stock now?

Before buying SanDisk stock, consider the following:

Motley Fool Stock Advisor’s team of analysts has identified the 10 best stocks for investors to buy right now. SanDisk was not among them. These 10 stocks have the potential to generate impressive returns over the next few years.

Consider when Netflix created this list on December 17, 2004… If you invested $1,000 at our recommendation, you’d earn $414,554!* Or when Nvidia created this list on April 15, 2005… $1,000 at our recommendation. If you invested $, you would earn $1,120,663!*

It’s worth noting here that Stock Advisor’s total average return is 884.% — compared to the S&P 500’s 193%, a market-beating outperformance. Don’t miss the latest Top 10 list available on Stock Advisor. Also, join our investment community built by retail investors, for retail investors.

See 10 stocks »

*Stock Advisor will return on February 16, 2026.

Adam Spatacco holds a position at Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Micron Technology, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.