David Eben put it well: “Volatility is not the risk we care about.” Our focus is to avoid permanent loss of capital. ”So it might be obvious that you need to consider debt when considering how risky a particular stock is. Because too much debt can sink a company. We note that LVMH Moët Hennessy – Louis Vuitton, Société Europe (EPA:MC) does have debt on its balance sheet. But is this debt a concern for shareholders?

What risks does debt pose?

Generally, debt only becomes a real problem if a company cannot easily pay it off, either by raising capital or with its own cash flow. The essence of capitalism is a process of “creative destruction” in which failing companies are ruthlessly liquidated by bankers. But a more common (but still expensive) situation is when a company needs to dilute shareholders at a cheap share price just to manage its debt. Having said that, the most common situation is one in which a company manages its debt reasonably well and to its own advantage. The first thing to do when considering how much debt a company uses is to look at its cash and debt together.

Check out our latest analysis for LVMH Moët Hennessy – Louis Vuitton Société Europe.

How much debt does LVMH Moët Hennessy – Louis Vuitton Société Europe have?

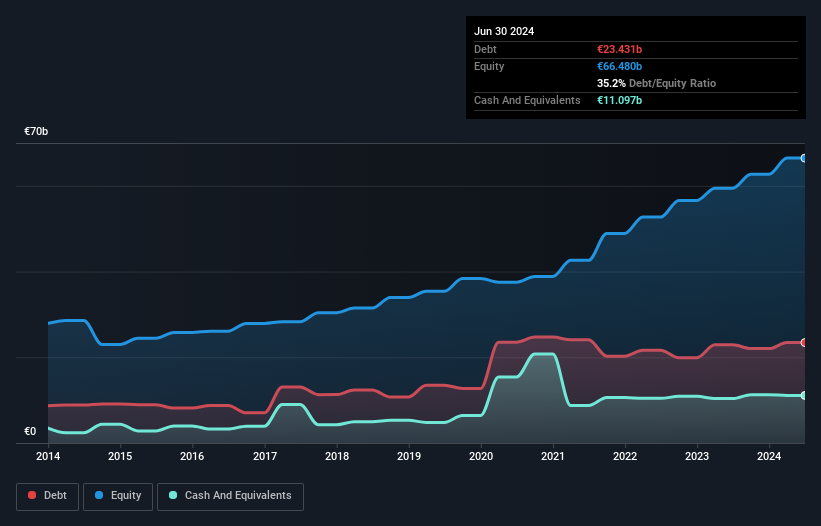

The graph below, which you can click on for more details, shows that LVMH Moët Hennessy – Louis Vuitton Société Européenne had debt of €23.4b as of June 2024. Almost the same as last year. However, it does have €11.1 billion in cash to offset this, resulting in net debt of around €12.3 billion.

How healthy is LVMH Moët Hennessy – Louis Vuitton Société Europe’s balance sheet?

The most recent balance sheet shows that LVMH Moët Hennessy – Louis Vuitton Societe Européenne had debt of €32.5b falling due within a year, and debt of €45.4b falling due beyond that. I understand. On the other hand, it had cash of EUR 11.1 billion and receivables worth EUR 7.97 billion that were due within a year. So its liabilities total €58.9b more than its cash and short-term receivables, combined.

Given LVMH Moet Hennessy – Louis Vuitton Société Europe’s market capitalization of €314.3b, it’s hard to imagine these debts pose much of a threat. Having said that, it’s clear that we need to continue to monitor the balance sheet to make sure it doesn’t take a turn for the worse.

We look at net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA) and calculate how easily a company’s earnings before interest, tax, depreciation, and amortization (EBITDA) cover its interest. Measure a company’s debt load. Expenses (interest burden). The advantage of this approach is that it takes into account both the absolute amount of debt (net debt to EBITDA) and the actual interest expense associated with that debt (interest cover ratio).

LVMH Moët Hennessy – Louis Vuitton Société Europe’s net debt is just 0.51 times its EBITDA. And its EBIT covers its interest expense by a whopping 24.3 times. So we’re pretty relaxed about our ultra-conservative use of debt. However, the other side of the story is that LVMH Moët Hennessy – Louis Vuitton Société Europe saw its EBIT decrease by 2.2% in the last year. If this decline continues, it will obviously be difficult to manage the debt. There’s no question that we learn most about debt from the balance sheet. But more than anything, it will be future earnings that will determine whether LVMH Moët Hennessy – Louis Vuitton Société Européenne can maintain a healthy balance sheet going forward. So if you want to see what the experts think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while tax preparers may adore accounting profits, lenders only accept cold hard cash. So it’s obvious that we need to consider whether that EBIT is leading to corresponding free cash flow. Over the last three years, LVMH Moët Hennessy – Louis Vuitton Societe Européenne generated solid free cash flow representing 58% of its EBIT. This was pretty much as expected. This free cash flow puts the company in a good position to pay down debt as needed.

our view

Fortunately, LVMH Moët Hennessy – Louis Vuitton Société Européenne’s impressive interest expense suggests that the company has a good debt position. But on a darker note, we’re a bit concerned about the EBIT growth rate. Taking all of the aforementioned factors together, we can see that LVMH Moët Hennessy – Louis Vuitton Société Européenne can handle its debt fairly easily. Of course, this leverage can improve return on equity, but it also brings more risk, so it’s worth noting this. Over time, stock prices tend to track earnings per share, so if you’re interested in LVMH Moët Hennessy – Louis Vuitton Société Europe, click here for an interactive graph of its earnings per share history It would be a good idea to check.

After all, it may be easier to focus on companies that don’t even need to take on debt. Readers can access our list of growth stocks with zero net debt completely free right now.

New feature: AI stock screener and alerts

Our new AI Stock Screener scans the market for opportunities every day.

• Dividend country (yield 3% or more)

• Small-cap stocks that are undervalued due to insider purchases.

• High-growth technology and AI companies

Or build your own metrics from over 50 metrics.

Explore for free now

Do you have feedback about this article? Interested in its content? Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.