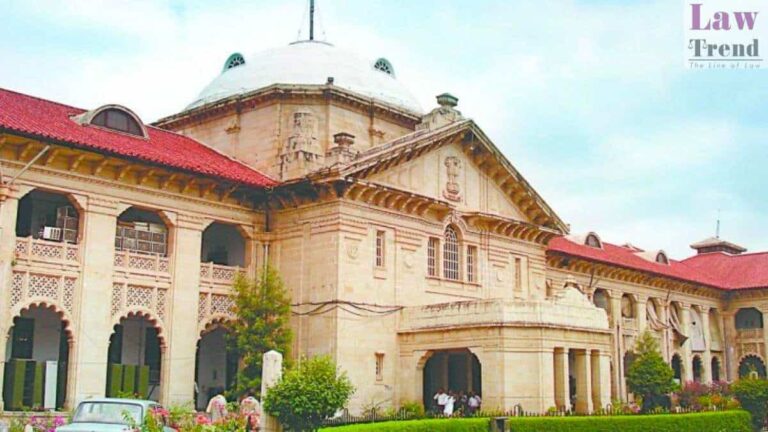

Reiterating the importance of discipline and integrity in the banking sector, the Allahabad High Court has dismissed an appeal filed by a former assistant manager of Canara Bank challenging his dismissal for alleged absenteeism and misconduct. The judgment, handed down by a Division Bench comprising Justices Vivek Kumar Birla and Yogendra Kumar Srivastava, requires employees of financial institutions to adhere to high ethical standards given their important role in upholding the trust of society. He emphasized that there is.

Background of the incident

The suit, registered as Special Appeal No. 614 of 2024, was filed by Mr. Manish Kumar, who was first appointed as a probationary officer of Syndicate Bank in 2008. After being promoted in 2014, he worked in various branches before transferring to the federal government. District Etawah branch of Canara Bank merged in 2017.

Kumar claimed that from November 22, 2018 to June 12, 2020, he was unable to perform his duties due to serious health issues, including diabetes. However, during this period, Kumar was reportedly held in jail on charges of impersonating a law enforcement officer or intelligence officer. He was later released on bail.

The bank has initiated disciplinary proceedings against Mr. Kumar for absenteeism and misconduct. Despite being interrogated and given multiple opportunities to provide evidence in his defence, Mr. Kumar was found guilty of truancy. His dismissal was ordered on March 31, 2021 and was later upheld by the bank’s appellate authority.

Dissatisfied with the outcome, Kumar challenged the dismissal in the Allahabad High Court, alleging procedural flaws in the investigation process and arguing that his absence was due to unavoidable circumstances and not deliberate. Ta.

major legal issues

1. Allegations of procedural deficiencies in the investigation:

Kumar claimed that the investigation process was rushed and that he was not given sufficient opportunity to defend himself. He also claimed that the investigation report was not provided to him, which was in violation of the principles of natural justice.

2. Unauthorized absence:

The court considered whether Mr Kumar’s prolonged absence could be justified on medical grounds or whether it amounted to a breach of professional duty.

3. Higher disciplinary standards for bank employees:

The court questioned whether the disciplinary action taken against Mr. Kumar was in line with expectations of integrity and accountability in the banking sector.

Court findings and decisions

After thoroughly considering the evidence, the court dismissed the appeal in favor of both the disciplinary authority’s findings and the single judge’s earlier decision denying relief. The court made several important points.

1. Providing appropriate opportunities:

Contrary to Mr. Kumar’s claims, the court found that he was given multiple opportunities to defend himself during interrogation. He received the indictment, participated in the hearing, and even filed responses to investigative reports that contradicted his claims that he had not received them.

2. Admission of unauthorized absence:

The court highlighted that Mr. Kumar had admitted to being absent for an extended period of time due to illness during the proceedings, but had failed to produce any substantive evidence to support his claim. Furthermore, he effectively admitted wrongdoing and asked for leniency.

3. Prejudice is not proven:

The court ruled that Mr. Kumar’s claim of procedural defects failed to establish actual prejudice caused by the alleged non-submission of the investigation report. The court relied on precedents, including the Supreme Court’s decision in ECIL v. Managing Director B. Karunakar (1993), which held that procedural deficiencies resulting in clear harm must be used to invalidate a disciplinary action. He emphasized that it must be done.

4. High standards for bankers:

The court emphasized that bank employees are custodians of public funds and must therefore demonstrate the highest levels of discipline, dedication and integrity. The court referred to Canara Bank v. VK Awasthy (2005) and reiterated that misconduct by bank officials undermines public confidence in the financial system.

The court concluded that Mr. Kumar’s prolonged absence and past disciplinary actions during his tenure justified dismissal. The judgment emphasized that his actions violated the ethical and professional standards expected of bank employees.