Indian financial markets fell across the board on Monday, with the rupee falling beyond the psychologically important 86 mark to the dollar, stock markets ending sharply lower, and yields on government securities (G-Sec) falling. It skyrocketed.

The market was weighed down by a strong dollar, hardening US bond yields, and rising global oil prices.

The Indian currency recorded its biggest single-day decline in nearly two years, closing at $86.5750 per dollar, down 61 paise from the previous closing price of $85.9650. During the day, it hit a low of 86.5825.

Since 2021, there have been 13 instances when the rupee depreciated by more than 60 paise in a single trading session, with the most recent occurrence on February 6, 2023, when the rupee plunged by 90 paise.

Harsimran Sahni, vice president and head of finance at Anand Rati Global Finance, said the main factor weighing on the rupee was a strong dollar supported by strong US employment growth in December. This raises expectations that the Fed will delay rate cuts, making the dollar more attractive to investors.

Sahni highlighted that India has seen a significant outflow of FPIs from the stock market so far in January as global investors shift towards high-yielding assets. These outflows increased demand for dollars as foreign investors exchanged rupee assets for foreign currencies.

“Domestically, dependence on imported oil is exacerbating the situation. With the US imposing increasingly tough sanctions on Russian oil, this will lead to a rise in global oil prices, leading to a weaker rupee.” ”Sahni said.

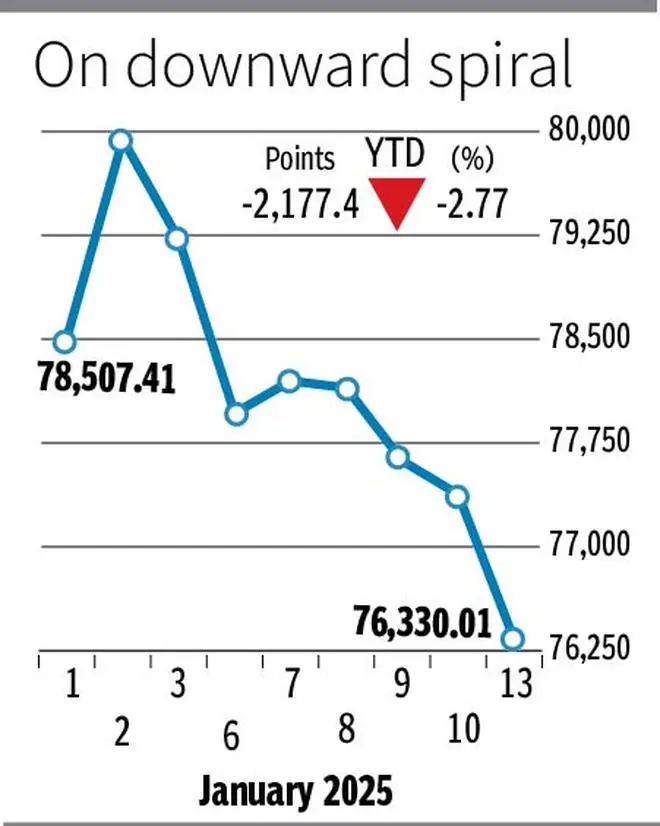

The leading 30-share BSE Sensex closed at 76,330, down 1.36% (or 1,049 points) from its previous close, with only four Sensex stocks – Axis Bank, TCS, HUL, and IndusInd Bank. rose, and the rest ended in the red.

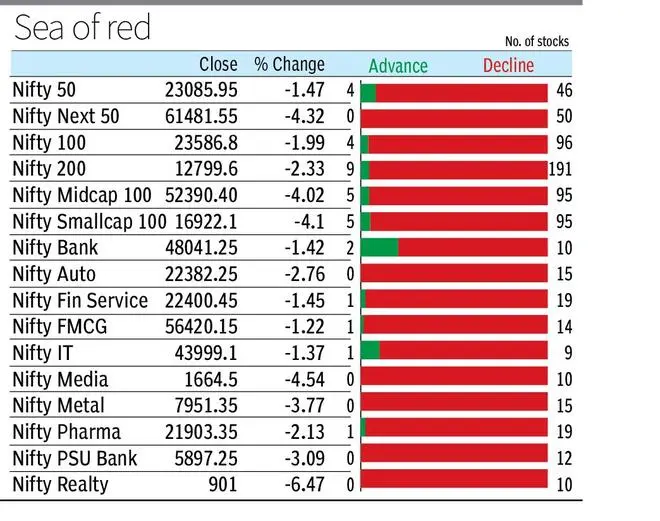

The 50-share NSE Nifty fell by 1.47% (down 346 points) from its previous closing price to close at 23,086 shares, with only four Nifty stocks gaining, Axis Bank, TCS, HUL, and IndusInd Bank, with the rest ended in the red.

Siddhartha Khemka, Principal Research Fellow, Wealth Management, Motilal Oswal Financial Services, said Indian stocks ended sharply lower for the fourth straight session on Monday.

“This has pushed the Nifty down almost 5% in the last seven trading sessions to a seven-month low. Selling was widespread, with all sectoral indices in the red. Real estate index led the decline. “It led the way, down 6.5%, followed by media, metals and consumer durables,” he said.

The yield on the benchmark 10-year G-Sec rose by about 8 basis points (bp), the largest single-day increase in about seven months, on the back of rising U.S. Treasury yields, rising oil prices, and a weaker rupee. It became. The security ended with a yield of 6.85% compared to the previous closing price of 6.77%.

Vinod Nair, Head of Research at Geojit Financial Services, explained the global situation: “We saw a strong decline in global markets, and a similar reaction in domestic markets was fueled by strong U.S. jobs data that suggested fewer interest rate cuts in 2025.”The dollar’s decline led to a similar reaction in domestic markets. Yields have risen, making emerging markets less attractive. ”