The United States has announced sudden tariffs on products made in Canada, Mexico and China on Tuesday.

If tariffs remain, RSM modeling will reduce the 0.36 % points from the growth of US GDP in the next 12 months.

Canada and Mexico have promised retaliation, but despite the longer the stand -off with China, they anticipate that these two countries will be resolved in the short term.

Without a solution, the impact on the US economy is important. Growth will be significantly slower from the average of 2.9 % over the past three years as inflation and interest rates rise. At present, the yield of the Ministry of Finance, about 4.5 %, can rise from 4.75 % to 5 %.

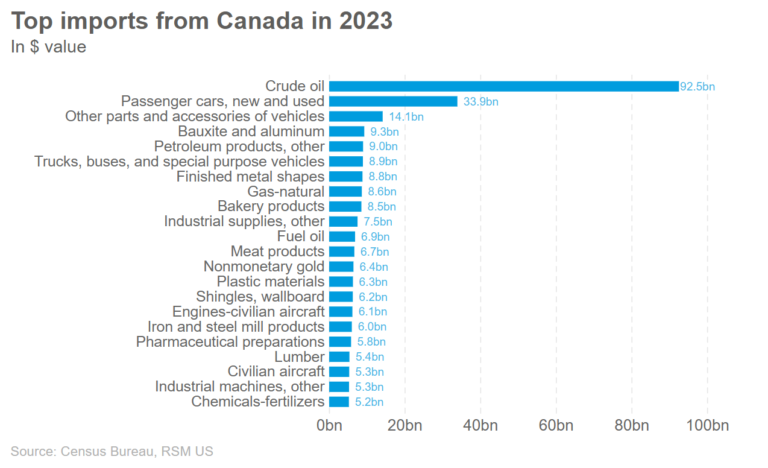

The danger is about 1.323 trillion in trade imports from China, Mexico and Canada, accounting for 43 % of US imports and 5 % of the $ 27 trillion General Product.

A new import tax from Canada and Mexico and 10 % of Chinese products and 10 % of the Chinese products have increased the average tariff rate from 3 % to 10.7 % of the current level based on modern trade patterns.

If the trade skirmish is escalated to turn into a full trade war, including the European Union, the US economic growth is 2 % as tariffs have reduced their growth and employment, blow off inflation, and expand their current account deficit. Please expect to return. Higher interest rate. However, the recession is unlikely this year,

The scenario, which delays growth, is in contrast to the current 2.5 % growth and the current baseline forecast of the US economy, 2.3 % to 2.5 %.

Regarding Canada and Mexico, the continuous trade position leads to these economics.

China will also feel the influence. The Chinese economy, which is upset by the collapse of the real estate market, will suffer as tariffs extend its release process.

In addition, investors and policy implementers need to expect a decrease in the purchase of agricultural exports from the United States and the original value of the original value associated with an increase in import taxes in the near future. 。

prediction

If tariffs are sticking, it will reduce 0.36 % points from US GDP growth over the next 12 months. At the same time, according to modeling, the personal consumption expenditure index, which is a priority inflation gauge of the Fed, increases by 0.4 %.

Customs duties push up 0.4 % of the PCE index, which is a priority inflation gauge of the Fed.

This estimated value includes depreciation of currency or a non -tax barrier, but is clearly modeled as a short -term phenomenon.

If the currency is depreciated and a non -tariff barrier is imposed, the scenario increases the risk of dragging much larger than the estimated GDP and inflation.

These possibilities led the federal preparation system to strengthen monetary policy, resulting in a much higher interest rate.

In 2018 research, the importer’s impact on the price was minimal.

This means that export supply is completely elastic. This means that US consumers and importers have all tariffs. The survey results are in line with various estimated methodology, indicating that customs duties have been completely passed to domestic prices.

Read more about insights on the RSM economy and intermediate market, and further deepen the RSM perspective on the impact of tariffs.

There are several explanations for this discovery. In the short term, export prices may be adhesive, but long -term adjustments may lead to low prices.

In addition, the exporter may not be able to raise the price again if the tariff was canceled, so the highly policy uncertainty may have prevented the price reduction.

It is the domestic price of the potential trade war.

According to other research on the New York Federal Bank Mary Amity and trade elasticity, the imports are reduced by about 6 % by 1 % of tariffs, which is due to these imported tax. You can estimate the loss of the deadweight.

With a 25 % tariff in Canada and Mexico and 10 % in China, GDP is equivalent to 0.14 % in 12 months.

Currently, we know that Canada will retaliate with a 25 % increase in US exports worth about $ 100 billion. Assuming that Mexico is doing the same thing and China has imposed a similar 10 % tariff, the loss of deadweight will increase to $ 8 billion per month, that is, 0.36 % of GDP in the next 12 months. 。

Again, GDP’s processing is irrelevant to the tax revenue that the government receives from higher tariffs. In the short term, American consumers will stand on the arrow.

More importantly, if customs duties are maintained, the FRB cost reduction campaign is ending, and the next movement from the Fed is very likely to raise the price.

As a result, the interest rate is higher in the length of the curve. In other words, the yield and mortgage ratio of 10 years, 4.75 % and more than 5 %, are significantly higher than 7 %.

If imported tax is maintained, the impact on employment will be a little more subtle, and the potential wage price spiral is the biggest risk, not an unemployment rate.

Employment is slow to 50,000 to 100,000 per month, but the unemployment rate may not change much due to the severe immigration policy and the speed of expulsion of abroad.

Similarly, the combination of trading tax and immigration restrictions can lead to wage prices, and can lead to a tax rate, as it tries to abolish the resurrected inflation of the central bank.

Take -out

The combination of trading tax and stricter immigration policy is to put an upward pressure on inflation. This is the risk of creating a condition that the Fed can be reduced in prices and reset long -term interest rates, which can choose to increase the price instead of lowering the price.

There is enough theoretical basis for all stakeholders to arrive as soon as possible to abolish trade tensions comfortably.

Is it necessary to help to reduce the impact of tariff increase? Learn about RSM trade and tariff advisory services.