If you buy a stock and hold it for years, you expect it to make a profit. Additionally, it’s common to want stock prices to rise faster than the market. However, Hewlett Packard Enterprise Company (NYSE:HPE) has fallen short of that second goal, with its share price up 62% over five years, below the market return. On a brighter note, more new shareholders will probably be happy with the 53% share price increase in 12 months.

It’s been a good week for Hewlett Packard Enterprise shareholders, so let’s take a look at the long-term fundamentals.

Check out our latest analysis for Hewlett Packard Enterprise.

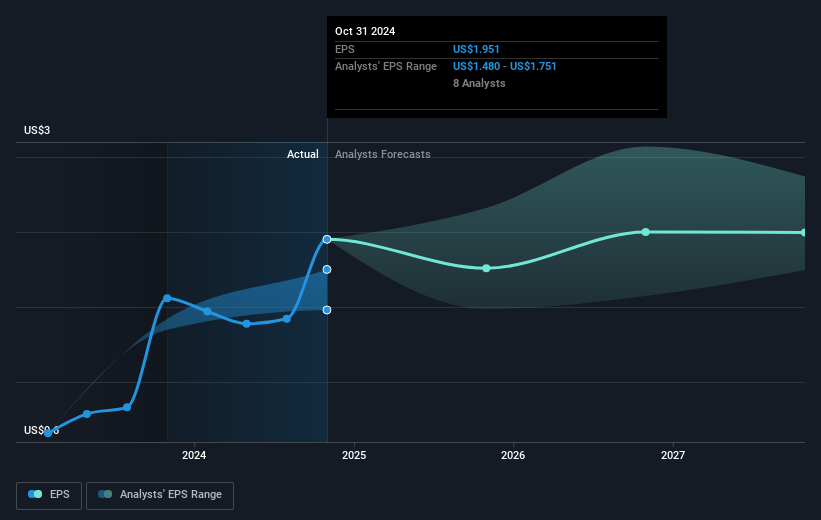

Markets are powerful pricing mechanisms, but stock prices reflect not only underlying business performance but also investor sentiment. By comparing earnings per share (EPS) and share price changes over time, we can learn how investor attitudes to a company have changed over time.

Hewlett Packard Enterprise has been able to grow its earnings per share at a rate of 20% per year over five years. The EPS growth is more impressive than the 10% annual share price increase over the same period. Therefore, we can conclude that the market as a whole is becoming more cautious towards stocks.

The image below shows how EPS has changed over time (unveil the exact values by clicking on the image).

We know Hewlett Packard Enterprise has been improving its earnings lately, but will its earnings grow? This free report showing analyst earnings forecasts can help you determine if EPS growth is sustainable. Helpful.

What will happen to the dividend?

When looking at investment returns, it’s important to consider the difference between total shareholder return (TSR) and share price return. Whereas the price/earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. Coincidentally, Hewlett Packard Enterprise’s TSR over the last five years was 91%, which is better than the share price return mentioned above. This is primarily due to dividend payments.

different perspective

We’re pleased to report that Hewlett Packard Enterprise shareholders have received a total shareholder return of 57% over one year. That includes dividends. The 1-year TSR is better than the 5-year TSR (the latter returning 14% per annum), so it looks like the stock has performed better recently. In the best-case scenario, this could signal real business momentum and suggest that now could be a great time to dig deeper. I think it’s very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well. To that end, you should be aware of the 1 warning sign we’ve spotted with Hewlett Packard Enterprise.

For those who like to find winning investments this free list of undervalued companies with recent insider buying, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Evaluation is complex, but we will simplify it here.

Discover whether Hewlett-Packard Enterprise is undervalued or overvalued with an in-depth analysis featuring fair value estimates, potential risks, dividends, insider transactions, and financial condition.

Access free analysis

Do you have feedback on this article? Interested in its content? Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.