Important points

Meta currently trades at a discount to the S&P 500 and cheaper than the rest of the Magnificent Seven.

Despite scandals and bad publicity, it has experienced strong growth throughout its history.

Investors appear to have mispriced digital advertising giants Meta and Alphabet.

10 stocks we like better than Metaplatform ›

meta platform (NASDAQ:Meta) is up nearly 2,000% since its 2012 IPO, but despite its success, it has long been a hated stock.

Throughout its history, the company has been plagued by scandals, boycotts, billions of dollars in fines, and antitrust attacks. Strategic decisions such as promoting the Metaverse have been ridiculed and the product’s addictive nature criticized.

Where to invest $1,000 now? Our team of analysts has revealed the 10 best stocks to buy right now. Continued “

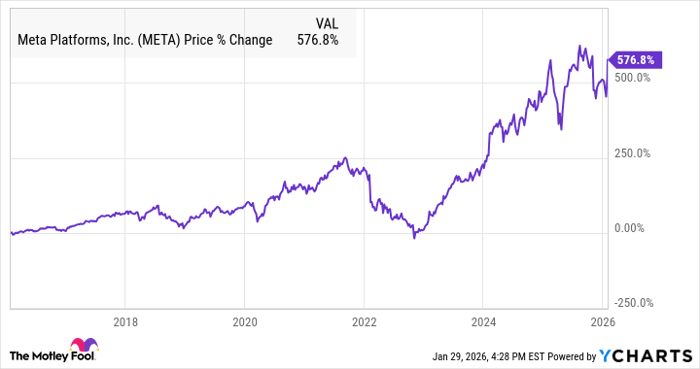

Nevertheless, the meta has delivered monster returns to investors. As the chart below shows, the stock price is up 577% over the past 10 years.

META data by YCharts

Meta’s strength was reflected in its latest earnings report, with shares up 10.4% on Thursday.

Sales rose 24% to $59.9 billion and operating profit rose 6% to $24.7 billion, but margins narrowed as spending on infrastructure and other areas increased.

Management also pleased investors with guidance for first-quarter sales of $53.5 billion to $56.5 billion. This represents a 30% increase in sales, which is the highest growth rate in five years. CFO Susan Lee credited the company’s investment in AI-powered advertising to improve targeting and measurement, as well as adding generative AI tools to help advertisers create ads.

Even after a 10% jump on the earnings release, the stock still looks cheap.

Image source: Getty Images.

big meta discounts

Adjusted for tax assessments from Big Beautiful Bill, Meta generated net income of $74.7 billion, or $29.04 per share, last year.

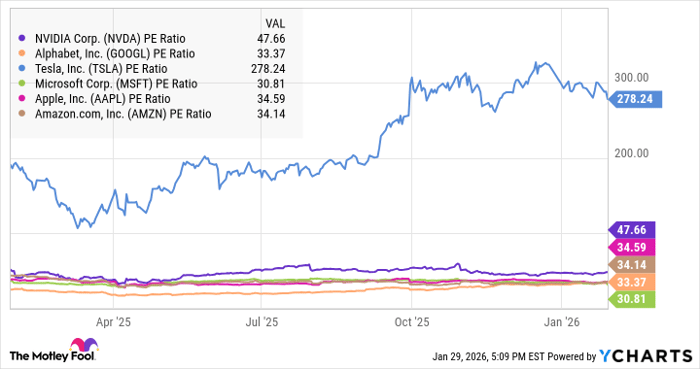

Based on this earnings figure, the company currently trades at a price-to-earnings ratio of 25.4x, making it cheaper than the S&P 500 and its “Magnificent Seven” stocks, which trade at a P/E ratio of 28.1x.

NVDA PE Ratio Data by YCharts

As you can see, according to the numbers above, Meta is currently trading at a discount of more than 20% to all of its “Magnificent Seven” peers, despite growing its revenue faster than all companies except Nvidia.

evaluation puzzle

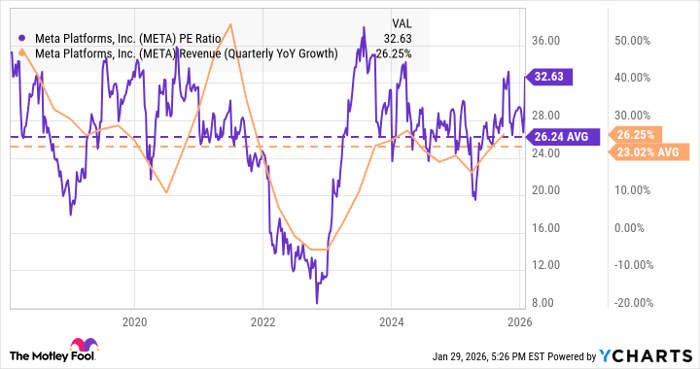

Meta has historically traded at a discount, and no other company of its size has grown so quickly at such a relatively low valuation. The graph below shows the sales growth and P/E ratio over the past 8 years.

META PE Ratio Data by YCharts

As you can see, Meta’s P/E ratio over this period averaged 26x, roughly in line with the S&P 500, and its earnings growth averaged 23%. You’d be hard-pressed to find another stock that has grown so quickly over so many years at such a low price.

The market doesn’t seem to know what to make of Metaplatform, and the same goes for Alphabet, which was trading at a deep discount until its recent surge.

These companies have two of the widest economic moats in the world and have the revenues and profit margins to prove it. They’ve created a duopoly in digital advertising, yet they’ve still been valued like the average company. Although they are software companies, they trade at a deep discount to software-as-a-service (SaaS) stocks, which are typically valued on multiples of sales rather than earnings.

But Meta and Alphabet have more value than subscription enterprise software products. They have platforms that billions of users use every day, sometimes for hours at a time, they have developed highly intelligent advertising models that generate billions in high profits around those platforms, and they have no significant direct competition.

Good news for investors

If you own a stock, you usually want the valuation to increase because it increases your income.

But Warren Buffett once argued that we should buy more stocks and hope for lower stock prices so that companies can buy back their stock at better prices. Low prices are also beneficial for stock buyers, allowing them to add to their portfolios at bargain prices.

Meta’s conservative valuation doesn’t mean the stock doesn’t offer outsized gains, but it reduces the risk of the stock crashing if the broader market declines.

It’s good for investors if stocks continue to be misunderstood and undervalued. It only serves to promote long-term benefits.

Should you buy Metaplatform stock now?

Before purchasing Metaplatform stock, consider the following:

Motley Fool Stock Advisor’s team of analysts has identified the 10 best stocks for investors to buy right now. The meta platform was not among them. These 10 stocks have the potential to generate impressive returns over the next few years.

Consider when Netflix created this list on December 17, 2004… If you invested $1,000 at our recommendation, you’d get $450,256!* Or when Nvidia created this list on April 15, 2005… If you invested $1,000 at our recommendation, you’d get $450,256! You’ll get $1,171,666!*

It’s worth noting here that StockAdvisor’s total average return is 942.% — compared to the S&P 500’s 196%, which is a market-beating outperformance. Don’t miss the latest Top 10 list available on Stock Advisor. Also, join our investment community built by retail investors, for retail investors.

See 10 stocks »

*Stock Advisor will return on January 31, 2026.

Jeremy Bowman holds positions at Meta Platforms and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.