According to Coingecko data, Litecoin, Jito and Bittensor have added 17% to 22% to their values over the past seven days. Bitcoin’s resilience and the overall recovery of crypto markets paves the way for altcoin’s profits.

Litecoin, Jito and Bittensor will extend their rally on Friday

Litecoin (LTC), JITO (JTO) and Bittensor (TAO) added value on Friday after a seven-day double-digit price rise. Bitcoin Fork (LTC), Solana-based tokens (JTO), and AI tokens (TAO) surpassed most Altcoins and ranked among the top 100 cryptocurrencies by market capitalization.

As Bitcoin continues to show resilience in the face of Hot US CPI, Trump tariff announcements and other macroeconomic developments, Altcoins is recovering from the revision along with the biggest cryptocurrency.

According to TradingView data, LTC scored 2.53%, while JTO and TAO added 5.68% and 2.98% to the day’s values.

On-Chain and Technical Analysis

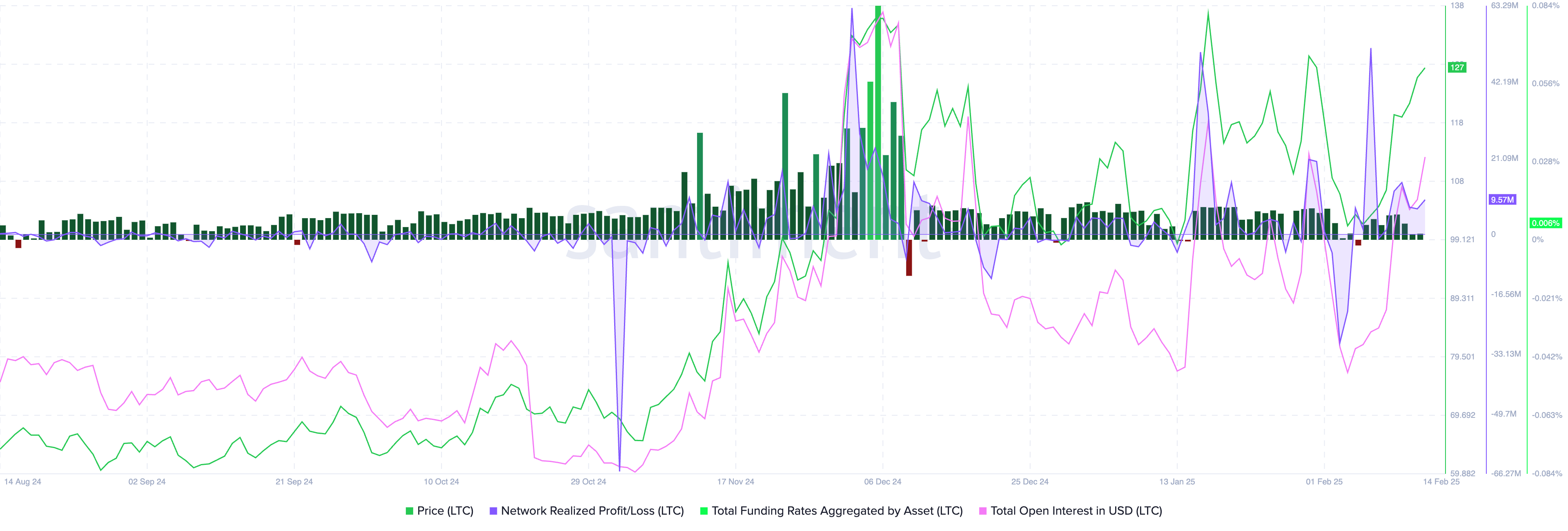

Santimento data shows that Litecoin’s fully open interest in USD rose steadily last week at $416.87 million on Friday. The network realized the profit/loss metric used to determine the net recognition profit/loss for all tokens that traveled on a chain on a particular day.

As observed in the chart below, the exchange-wide funding rate remains positive.

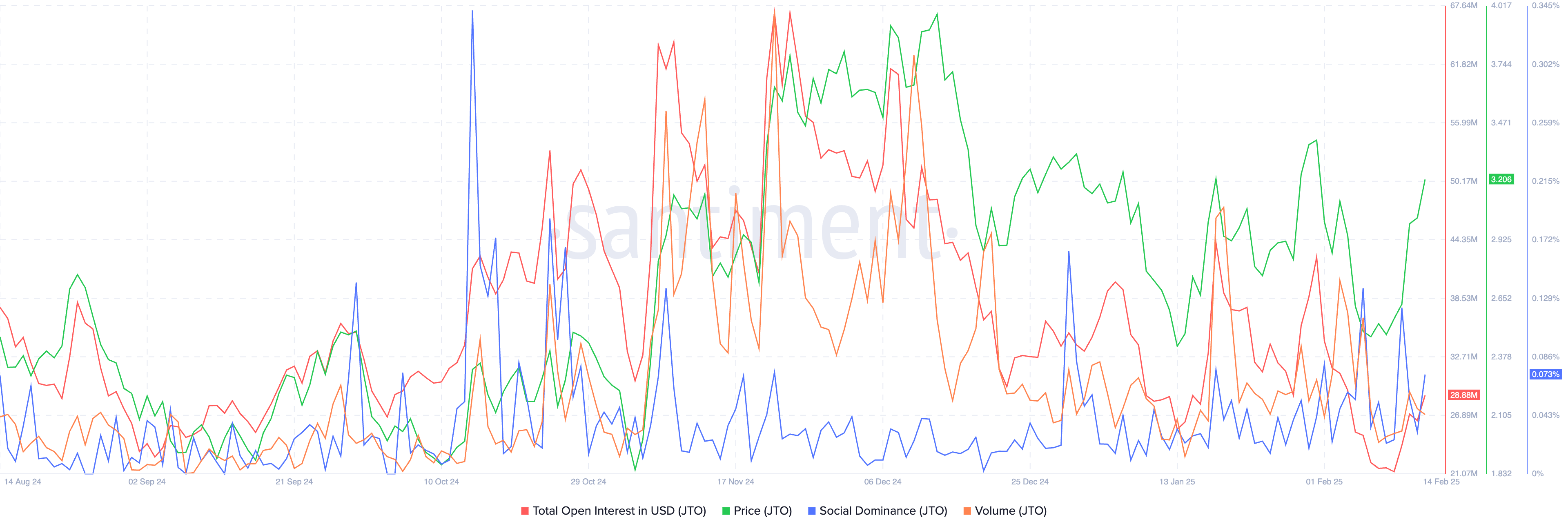

This week, as with Litecoin, Jito’s full interest rose. There is a surge in social control. In other words, tokens are more relevant between traders and market participants. Trade volumes rose, and Solana-based tokens recovered in response to demand from institutions and retailers.

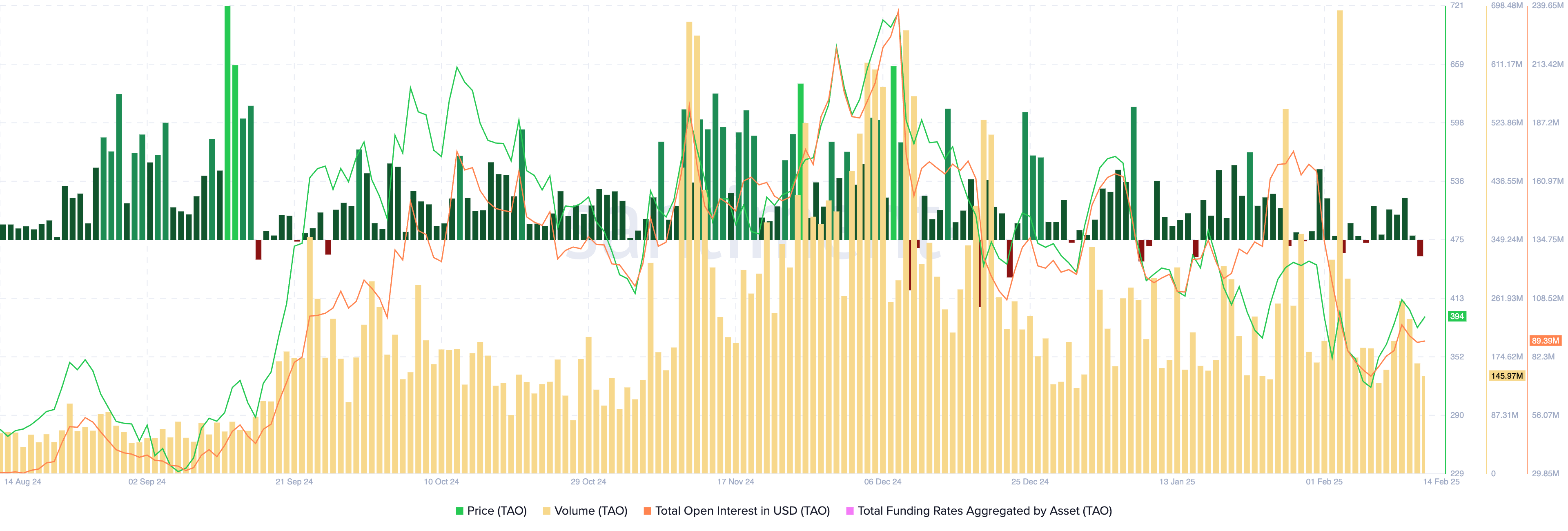

Chain-on-chain data is stable at an average level, showing that last week there were some positive spikes. Spikes were recorded on February 11th, as seen in the Santiment chart below. Funding rate data shows negative spikes today. This means that on Friday, derivative traders will be bearish on bittensers, so traders should keep their eyes on it.

Litcoin was able to extend its profits by nearly 10% next week by attempting to retest $141.22 on its 2025 peak, as observed in the LTC/USDT Daily Price Chart. Two momentum indicators, RSI and MACD, support Litecoin’s benefits.

The RSI reads 62 and is tilted upwards, while the MACD flushes the green histogram bar above the neutral line. In other words, there is a fundamentally positive trend in LTC price trends.

Litecoin was able to find support with a fair value gap (FVG) between $109.18 and $117.81 if the fix occurred.

The Solana-based JTO can test resistance at its peak on December 16th for $3.841. The next important resistance is the December 2024 height, R2 is $4.340.

JTO’s long-term price target is the highest 2024 $5.330 observed in the daily time frame of JTO/USDT. RSI and MACD support further benefits of tokens.

JTO was able to find support between $2.694 and $2.920 on FVG if AltCoin prices fell.

TAO collected nearly 13% to $445.60 to test resistance at the upper limit of the imbalance zone of the daily price chart. Tao was able to find support for $341.50. This is a stable level of support for several weeks.

The RSI is tilted upwards, and the MACD flushes the green histogram bar above the neutral line. TAO price trends have fundamentally positive momentum in daily time frames.

LTC, JTO and Tao market movers

Eric Balknath, a senior ETF analyst at Bloomberg, tweeted about the possible approval of the Litecoin ETF. Balchunas says Litecoin is 90% ahead of the ETF approval chances.

Litecoin is followed closely by Solana. Balchunas explains that experts have calculated the odds for only “33 ACT IBIT-ESCE filing.” Balchunas believes Futures or Cayman-Subsidiary Type 40 ACT products could similarly earn approval.

ETF hype was a key market activist for Litecoin this week.

The Securities and Exchange Commission’s Cryptographic Task Force lined up meetings with projects like Jito Labs to promote forecasts of the protocol’s positive development. This emerged as a key market activist for JTO Price this week.

🚨NEW: The @SECGov Crypto Task Force is keeping a log of all of its meetings with industry players.

So far the task force has met with @BlockchainAssn, @jito_labs & @multicoincap, @Nasdaq and Colin Lloyd, a partner at @sullcrom’s Commodities, Futures and Derivatives and Capital… pic.twitter.com/DxfMMuf0TB

— Eleanor Terrett (@EleanorTerrett) February 14, 2025

For Dynamic Tao’s Bittensor, an update that was as important as Ethereum’s merge was implemented on Thursday. Update forecasts have made Tao prices higher all week, and recent profits could be an extension of the rally.

The update in question, Dynamic Tao, will be implemented within a year, unlike Merge’s timeline.

One of the biggest crypto asset managers, Grayscale tweeted about the upgrade, its importance and its impact on the Crypto and Tao ecosystem.

Derivative Data Analysis

Coinglass’ Litecoin derived data shows that the value of open derivative contracts at LTC has increased by almost 12% over the last 24 hours. The OI rose to $719/18 million. The long/short ratio is above 1. That means derivative traders are bullish on Litecoin as of Friday.

JTO’s OI is $35.06 million, close to the 2025 average. According to Coinglass data, OI has risen over the past three days.

TAO points out as a decrease in the amount of derivatives trade and an increase in OI. Derivative traders may be weakened by Tao as the long/short ratio of the 24-hour time frame is slightly submerged below 1.

Beyond derivative exchange, Binance, and OKX, the ratio is above 1. Traders should keep an eye on Tao’s price trends due to shifts.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.