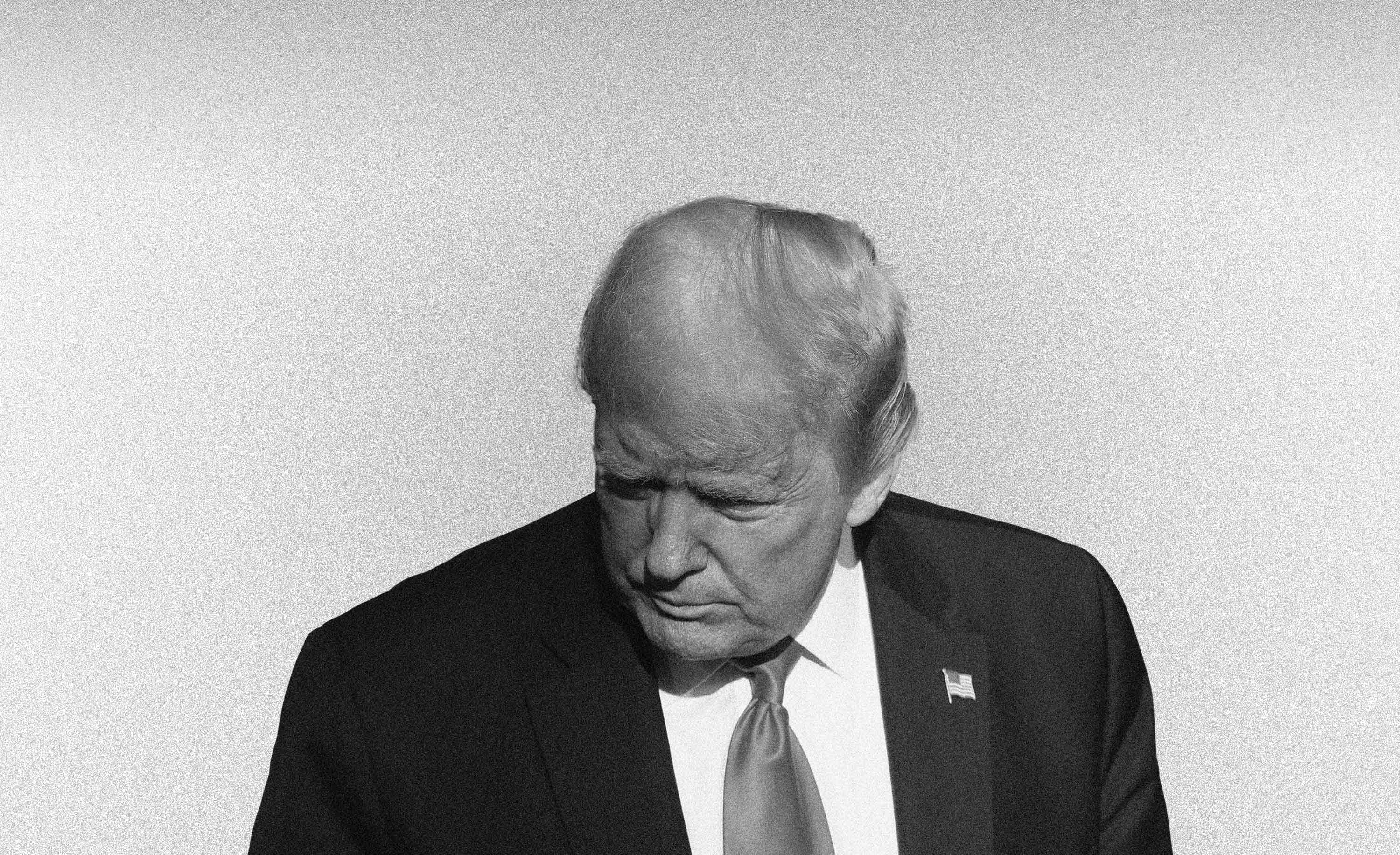

Original image taken by: Chip Somodevilla/Getty Images

by sam potter January 1, 2025

Wall Street’s predictions for next year are typically defined by expectations for growth, inflation, and other dull but valuable economic indicators. In 2025, all of that will be overshadowed by one person. And he is by no means dull.

Donald J. Trump’s return to the White House dominates this year’s investment forecasts published by the world’s largest banks, advisors and asset managers. Overall, his expected pro-business policies are fueling optimism, especially regarding American companies and assets. But while his tough words on global trade are also creating tension, his general unpredictability has many forecasters worried.

As we enter 2025, Bloomberg News has collected more than 700 key calls from more than 50 large financial institutions and presented them here for ease of analysis and comparison. Among them, the reader will find an unusual degree of agreement across a variety of topics.

Join Bloomberg Markets’ live Q&A on Thursday, January 2 at 11:15 a.m. ET for more stock market predictions and answers to reader questions.

The U.S. economy and assets are expected to advance strongly again, enjoying new momentum under President Trump and benefiting from the relative lack of attractiveness in other major markets, much of which will be driven by President Trump’s tariffs. There is a possibility of getting hit. JPMorgan Chase says it will lead to a world in which “American exceptionalism is strengthened.”

Inflation is seen as largely under control, although President Trump’s trade barriers and tough stance on immigration are unlikely to hit the target. “It will take longer than expected for the Fed to hit the last mile towards its inflation target,” Apollo Global Management said. The company is one of several companies that believe interest rate cuts will be more gradual than the market is currently pricing in.

Almost all financial institutions are warning investors not to expect stock returns to exceed 20% this year, as they did a year ago. But few are willing to put an end to the stock boom fueled by artificial intelligence. BNY believes that “AI’s role in the world will exceed that of other technologies that drove earlier trends.” No one else can match this bullish stance, but many expect profits to grow as adoption of the technology spreads.

And given the current tight pricing and continued concerns about excessive government borrowing, this may not be the year of the bond. However, starting yields are strong on both interest rates and credit, and many companies will agree with Schroders that “the old reasons for holding bonds to generate income are back.”

Meanwhile, with low expected returns from major assets like stocks and so much uncertainty surrounding President Trump and U.S. policy, Wall Street believes diversification is the name of the game. Companies say they will look to alternative assets such as private markets and hedge funds. And of course, many recommend turning to a trusted professional money manager to help you navigate this complex situation.

This year’s call is divided into sections covering key themes and assets. Each section is ordered based on the level of confidence as determined by Bloomberg, with the most confident calls appearing first. If the confidence levels are similar, calls are ordered alphabetically by institution name. Finally, new filtering tools allow you to view calls from multiple specific agencies at once.

From Trump 2.0 to prohibitively expensive US assets to the lurking threat of bond vigilantes, this is what the brightest minds in finance are seeing in the year ahead.

Base case: America first (again)

Lower interest rates and pro-growth policies should support modest global expansion, with the United States largely leading the way. Although there are many risks, especially the unpredictability of the new US administration, solid, but not exceptional, returns are the base scenario for most companies on Wall Street. Let’s call it cautious optimism.

scroll through calls

Growth: US vs. World

The U.S. government’s so-called “red sweep” is expected to usher in an era of pro-business regulatory flouting that will boost U.S. activity. Confidence in Europe’s revival is low, and China is seen as struggling to cope with the ongoing slowdown.

Inflation: suppressed, but not eliminated

President Trump’s potential trade barriers and aggressive approach on immigration are seen as fuel for new inflation as the Federal Reserve struggles to bring inflation down to its target. There is. Still, compared to recent years, inflation is generally seen as subdued and within a range both in the United States and abroad.

Monetary policy: US interest rate cut reduction

President Trump’s potential inflation policy could limit the Fed’s maneuverability, potentially cutting rates less than expected and ending with higher than expected rates. The Bank of England faces similar troubles. Europe is expected to lean dovish with multiple cuts. Japan is the only country where major banks are raising interest rates.

Fiscal policy: tax cuts and cuts

The sustainability of government spending is a major concern around the world, but no one expects countries to rein in government spending. Concerns about US President Donald Trump’s tax cuts have been offset by optimism about their potential to boost growth.

Tariff: Tactical Awareness

While everyone agrees that new tariffs are on the way, many believe that Trump’s hard-line rhetoric is a negotiating tactic and that actual trade barriers are highly targeted and more aggressive in the worst-case scenario. Some people predict that it won’t. China will bear the brunt.

Stocks: Widespread expansion

Wall Street is hoping for more stock gains from tech giants. That means a boost for small- and mid-cap stocks in the U.S., which remains the preferred market for most companies, even if it doesn’t match recent returns. Cheap international companies may be able to offer you a bargain.

Bonds: It’s all about the income.

The situation is complicated by the expectation that interest rates will be more volatile and that U.S. Treasury yields may rise. Still, Wall Street views bonds with relatively attractive yields as an important source of income. Most people say they will run out of cash.

Credit: Expensive but possible

Corporate bonds appear to be priced in perfectly, meaning the risk is likely tilted to the downside. But yields are solid, central banks are cutting interest rates, and default risk is seen as relatively low. Many companies prefer credit to government bonds as a source of income.

Commodities: Go for gold

Wall Street is divided on whether gold will continue to shine, but bulls see it as a good hedge against an unpredictable macro environment. Improved growth and the construction of technological infrastructure (data centers, power plants) could lead to higher prices for base metals. No one is particularly bullish on oil.

Currency: Dominant dollar

Although the dollar looks expensive, overall Wall Street believes that Trump’s policies will push the dollar further higher in the short term. Some institutions expect parity with the euro.

Alternative. Assets: Private Market Rules

In an era of falling interest rates, high public asset valuations and widening dispersion in performance, Wall Street is touting both private markets and hedge funds as potential sources of diversification and profit.

Multi-asset: diversification

America’s optimism about all things is ushering in a new era of high-priced assets and unpredictability. Although unable to escape the gravity of U.S. assets, Wall Street is also looking to diversify, turning to hedging and cautiously exploring opportunities overseas.

AI: Long live the revolution

Artificial intelligence has the potential to be a doubly beneficial driver, as its introduction brings new productivity gains and businesses and governments invest heavily in the infrastructure needed to power the revolution. there is.

Risk: Trade War II

The bursting of the AI bubble and bond investors losing patience with the profligate government are among the big concerns on Wall Street. But the biggest one so far is that President Trump has imposed tougher-than-expected tariffs, sparking retaliation and hurting global growth.

With the help of: Helen DurandMatthew Burgessisabel leekatherine bosleyLu WangJustina Leemark cudmoreCormac MullenDenitsa Tsekovaconor cooperSimon Kennedyrachel evans Editor: michael regan Creator: jeremy scott diamond

methodology

This article was compiled by Bloomberg News from a sampling of opinions and research shared in the media and/or published online. Much of the content was originally published as marketing material and contains additional disclaimers.

It is presented here to enable comparison and analysis across major financial institutions. Most entries have been edited for style, clarity, and length, and the list is not all-inclusive. Bloomberg selected the views it deemed important and limited the number of calls to 15 per agency.

Institutions often hold multiple views across different sectors, so the views shown may not represent the full range held by each company. Where possible, input from a multi-asset or macro team has been preferred as it provides a broad overview of the market. In some cases, input from different departments may be combined. Publication and display is entirely at the discretion of Bloomberg News.

Some research institutions may not be included because their research is unavailable or we believe it is outdated or inappropriate. Most of the 2025 outlooks were released well before the end of 2024, so they may not incorporate price movements or events that occurred later in the year, such as the last Federal Reserve meeting in 2024. The call may have been excluded on this basis.

As determined by Bloomberg News, the calls are apparently ordered by level of guilt. If these levels are similar, calls are displayed alphabetically by institution name. The base case is the one identified by Bloomberg. Editorial judgment has been used throughout.