Getty Images

Getty ImagesUS job growth unexpectedly surged last month, suggesting the world’s largest economy has no intention of relinquishing its claim to be the “envy of the world” anytime soon.

Here are three things we learned from the latest numbers.

1. The U.S. economy is stronger than expected

For years, there have been whispers of concern that the world’s largest economy could suffer a downturn.

It consistently proves its doubters wrong, and last month was no exception.

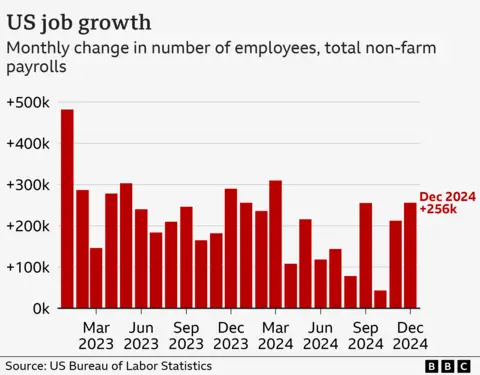

Job growth in December far exceeded analysts’ expectations by about 160,000, with employers adding 256,000 jobs and the unemployment rate rising to 4.1% from 4.2% in November, the Labor Department said. decreased.

Overall, 2.2 million jobs were added last year. This equates to an average of 186,000 people per month.

Although this has slowed down compared to the same period last year, it’s still a pretty healthy number.

Average hourly wages increased by 3.9% last month compared to December 2023. While this is a solid increase, it is not strong enough to cause analysts to worry that rapid wage increases will lead to a sharp acceleration in price increases.

Nathaniel Casey, investment strategist at asset management firm Evelyn Partners, called it “the crown jewel of labor market liberation.”

2. The number of interest rate cuts may be reduced.

The U.S. central bank, which is responsible for maintaining both price and employment stability, cut interest rates in September for the first time in more than four years, saying it wanted to stem any signs of weakness in the job market.

That raised hopes for many prospective U.S. borrowers, who were facing the highest borrowing costs in nearly 20 years and had been waiting for them to come down.

But this month’s strong data suggests concerns about the job market may have been premature, and pressure on the bank to act has eased.

Following the report, interest rates on US 10-year and 30-year bonds soared, with the latter exceeding 5%.

Investors had already trimmed their bets on rate cuts this year, worried by signs that the bank’s progress in stabilizing prices was stalling.

Policies called for by President-elect Donald Trump, such as sharply increasing border taxes and deporting immigrants, also risk raising prices and wages and adding to inflationary pressures.

Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management, said that even if next week’s inflation data shows that inflation is slowing, the jobs report will He said that means he doesn’t expect the Fed to cut rates “any time soon.” ”

3. Higher U.S. borrowing costs also mean higher global interest rates

The interest rates set by the U.S. central bank have a significant impact on borrowing costs for many loans, not just in the United States.

Borrowing costs have risen globally in recent months in response to expectations that U.S. interest rates are likely to remain high for an extended period of time.

In the UK, for example, interest rates on 30-year government bonds hit their highest level in more than 25 years earlier this week, putting pressure on the government as it tries to set spending and borrowing plans.

While the latest US jobs numbers may be good news for the US economy and the dollar, Seema Shah, chief global strategist at Principal Asset Management, said the numbers were “painful for global bond markets, and for UK government bonds in particular.” He warned that it would be news. National bonds and debt.

“We have not yet reached peak yields, suggesting that some markets, particularly the UK, cannot afford further stress,” he said.