Image source: Getty

India’s economic liberalization in the 1990s under Prime Minister Narasimha Rao and the adoption of the Look East and subsequent Act East policies strengthened ties with Southeast Asia and boosted trade with countries such as Indonesia. It was done. Furthermore, India’s involvement in ASEAN, particularly through agreements such as the ASEAN-India Free Trade Agreement (AIFTA) and the ASEAN-India Trade in Goods and Services Agreement (AITIGA), has improved trade by reducing tariffs and increasing market access between the two countries. Expanded it further. .

Indonesia continues to grow as an important trading partner, surpassing Singapore as India’s sixth largest trading partner overall by 2022.

Although Indonesia was a major trading partner, until 2000 it lagged behind countries such as Singapore and Malaysia in terms of its share of India’s total trade. However, by 2003, it had surpassed Malaysia and reached US$3.2 billion. By 2010, Indonesia had emerged as one of India’s top 10 trading partners as India deepened its engagement with ASEAN. This growth was clearly reflected after the AIFTA entered into force, with total trade increasing to USD 15.6 billion, especially in areas such as refined petroleum, petroleum, and petroleum. briquettes, palm oil. Indonesia continues to grow as an important trading partner, surpassing Singapore as India’s sixth largest trading partner overall by 2022. Nevertheless, challenges remain in the bilateral relationship when it comes to trade and investment.

Trade pattern between India and Indonesia

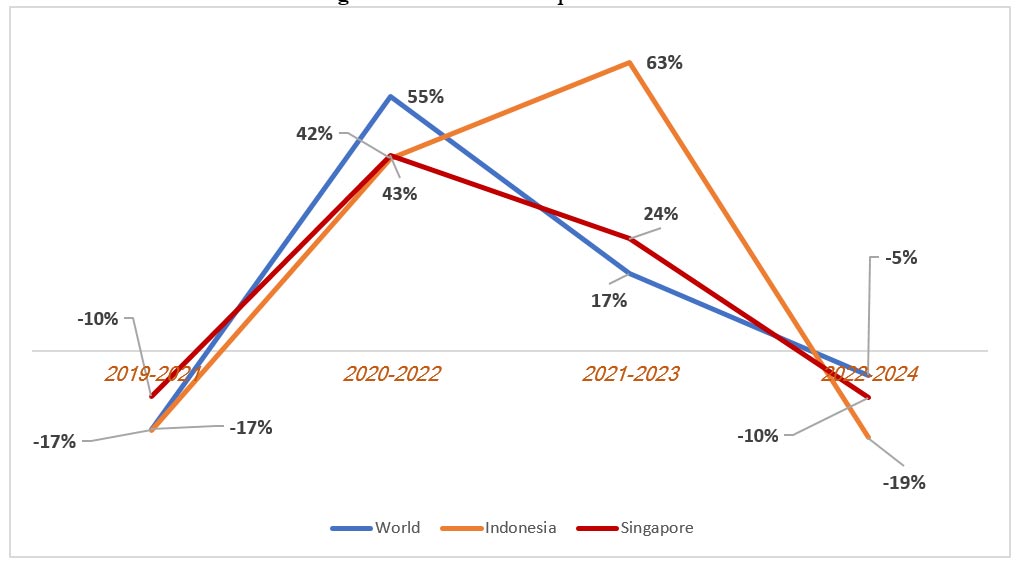

To analyze trade trends between India and Indonesia, check India’s trade with Indonesia, Singapore (currently India’s largest trading partner in ASEAN) and other countries of the world for the past five years (2019-2024). It may be helpful to compare. Shown in Figures 1 and 2.

Figure 1: India’s total imports

Source: Created by author

As shown in Figure 1, India experienced a significant decline in global imports from 2019 to 2021, impacting imports from Indonesia and Singapore. The COVID-19 pandemic has caused significant disruptions to supply chains and significantly reduced imports and exports to both countries. Exports of major sectors such as petroleum products decreased significantly due to the sharp drop in global crude oil prices and decreased demand.

The COVID-19 pandemic has caused significant disruptions to supply chains and significantly reduced imports and exports to both countries.

However, from 2020 to 2022, India’s total imports, including imports from Indonesia and Singapore, recovered. From 2021 to 2023, India’s global imports increased by 17%, with Indonesia contributing 63% and Singapore 24% to this growth. During this period, Indonesia surpassed Singapore to become India’s largest trading partner. This surge in imports from Indonesia is due to changes in India’s import policy, with basic import taxes on crude oil such as crude palm oil, crude soybean oil, and crude sunflower oil being completely abolished. Regarding refined oils, the basic tax on refined soybean oil and sunflower oil has been reduced from 32.5 percent to 17.5 percent, and the tax on refined palm oil has been reduced from 17.5 percent to 12.5 percent.

Another potential reason for the surge during this period is the disruption in the global edible oil supply chain caused by the Russo-Ukrainian war, which has increased India’s dependence on alternative vegetable oil sources such as Indonesia. Ta. However, as shown in Figure 1, India’s global imports declined by 5% from 2022 to 2024, while imports from Indonesia declined by 19%. The decline was marked by a 32% decline in mineral products and a 20% decline in animal and plant by-products, the top two imported goods during the period, according to Commerce Department data. One reason for this decline is that Indonesia temporarily banned palm oil exports in 2022 to stabilize domestic supplies and control local prices, disrupting the supply chain of Indian importers. .

The Government of India launched the National Mission for Oil Palm Edible Oil (NMEO-OP) in August 2021 with the aim of expanding oil palm production area and increasing crude palm oil production to 1.1 million tonnes by 2025-26. Raised. Promote self-sufficiency in edible oil production. This also explains the sudden decline in India’s imports from Indonesia.

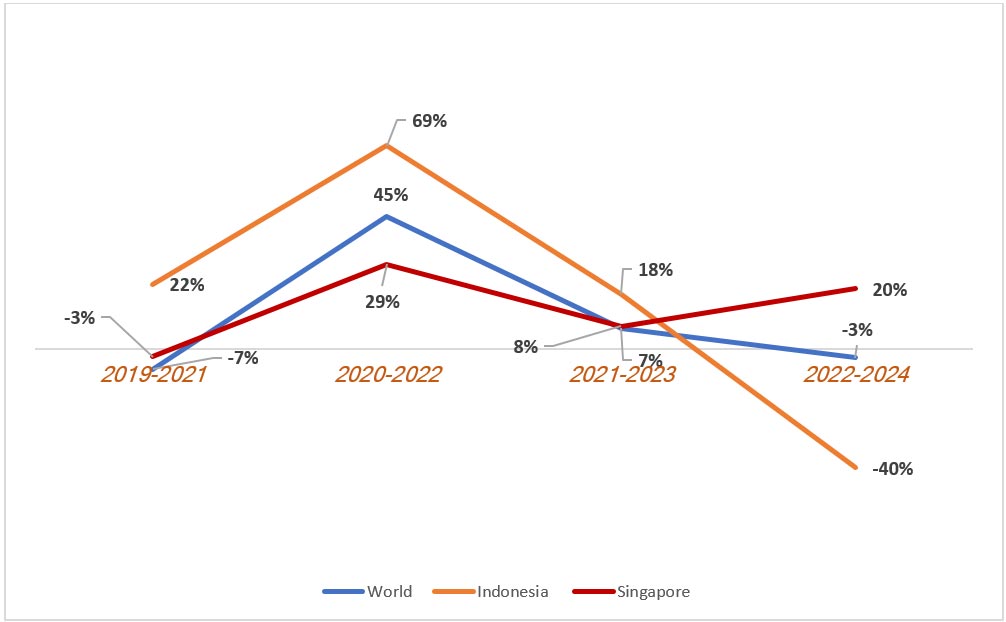

Figure 2: India’s total exports

Source: Created by author

Conversely, on the export front, India’s global exports declined by 7% from 2019 to 2021, but exports to Indonesia increased by 22% during the same period, reflecting strong trade ties despite the global recession. . From 2020 to 2022, India’s global exports grew by a whopping 45%, while exports to Indonesia surged by 69%, outpacing Singapore’s growth rate. Like crude oil and refined petroleum, mineral fuels and mineral oils became major export products, accounting for 28% of total exports in 2021-2022, and then rising to 39% in 2022-2023. In 2022, Indonesia’s most imported product was refined petroleum.

India’s exports to Indonesia fell by 40% from 2022 to 2024, reflecting the deterioration in trade relations. This decline also coincided with a significant 73% decline in mineral products exports and a 19% decline in vehicle exports (excluding railways and trams), which were India’s top two export categories during this period. .

From 2020 to 2022, India’s global exports grew by a whopping 45%, while exports to Indonesia surged by 69%, outpacing Singapore’s growth rate.

One of the reasons for this decline is that India imposed a ban on trade in crushed rice in 2022, followed by a ban on wheat exports in 2022, and a ban on non-basmati rice exports in 2023. . A minimum export price for onions was also introduced. Furthermore, in 2024, a 40% export tariff was imposed on staple vegetables, and onion shipments remained prohibited for more than six months. In June 2024, India’s exports to Indonesia also declined, mainly due to a decline in exports of sugar products as India banned exports for the 2023-24 season to ensure enough sugar for domestic consumption. It decreased every year. and ethanol production.

Therefore, a stable and positive trade relationship will be observed between India and Indonesia from 2020 to 2023, and the relationship will reach its peak during 2021 to 2023. However, the downward trend continues from 2022 to 2024, consistent with the decline in India’s overall trade with the world. Trade relations highlight two important challenges: India and Indonesia’s interference in their domestic policies, which impedes trade between the two countries, and the concentration of trade in a few areas, which has a major impact.

Challenges and opportunities

As Table 2 shows, India’s CAGR relative to the world shows a balanced and consistent growth of 7% across imports, exports, and total trade. Meanwhile, trade between India and Indonesia is growing at an above-average pace. Unlike Singapore, imports from Indonesia (9%) are growing faster than exports to Indonesia (8%).

The 9% CAGR in total trade between India and Indonesia reflects the deepening and strengthening of trade relations. While the trend toward increased imports indicates a trade imbalance, the overall strong growth in both directions highlights the growing economic interdependence between the two countries. As India continues to focus on Southeast Asia, Indonesia’s importance as a trading partner will continue to grow.

Table 2: Compound annual growth rate (CAGR) of India’s exports, imports, and total trade with the world, Indonesia, and Singapore from 2019 to 2023

Country Import Export Total World 7% 7% 7% Indonesia 9% 8% 9% Singapore 8% 10% 9%

Source: Created by author

Amid potential geopolitical turmoil, an approaching global recession, and shifting global demands, India and Indonesia’s trade relationship remains strong, although not without its challenges. A significant decline of 24% in trade was observed from 2022 to 2024. Furthermore, India’s imports from Indonesia consistently exceed its exports to Indonesia, and Indonesia enjoys a favorable trade balance. India’s trade deficit with Indonesia has steadily worsened since 2019, from USD 10,932 million to USD 17,421 million.

Some obstacles, such as non-tariff barriers, affect 70 percent of Indonesia’s tariff lines and 45 percent of India’s tariff lines. Moreover, FTA utilization remains low at around 25%, including the important exclusion lists that are maintained (11% for India and 4% for Indonesia).

Major Indian companies such as Tata Power and Reliance are actively working on projects ranging from renewable energy to manufacturing.

Despite these challenges, there is some optimism. India has invested heavily in Indonesia, amounting to approximately US$54 billion, mainly through infrastructure, energy, textiles, automobiles and IT sectors. Major Indian companies such as Tata Power and Reliance are actively working on projects ranging from renewable energy to manufacturing. Although Indonesia’s investment in India remains small at USD 647 million, Indonesia aims to diversify its trade and investment opportunities, particularly by investing in new capital and key industries such as automobiles and pharmaceuticals. Encourages further investment in India. There is great potential for increased trade in digital technologies between India and Indonesia. Both countries have made great strides in digital transformation, with India excelling in building digital public infrastructure, improving public service delivery and driving innovation. At the same time, Indonesia has advanced the digitalization of MSMEs.

Indonesia can take inspiration from Singapore by exploring sectors such as technology, pharmaceuticals and manufacturing, and diversifying its export portfolio beyond traditional goods. This shift will reduce dependence on commodities such as palm oil and coal. By investing in infrastructure to strengthen logistics, streamline digital trade processes, and formalize bilateral agreements, Indonesia will facilitate smoother trade flows and strengthen economic ties with key partners. You can. Adopting these strategies could help Indonesia become a more competitive player within ASEAN and strengthen its trade with India. As both countries pursue ambitious economic goals (India aims to become the third largest economy by 2027 and Indonesia aims to become the fifth largest economy by 2045), their trade will increase. The relationship has expanded significantly and could reach USD 50 billion in the near future.

Ishanya Sharma is a research intern and Abhishek Sharma is a research assistant at Observer Research Foundation.

The above views belong to the author. ORF research and analysis is now available on Telegram. Click here to access our carefully selected content (blogs, long-form articles, interviews).