After START-UP DEEPSEEK, a Chinese artificial intelligence company, surprised Silicon Valley, the stock of technology seems to have progressed much less than US rivals.

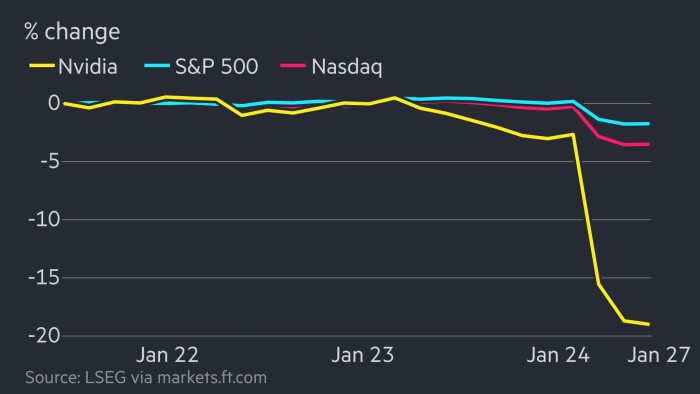

NVIDIA’s shares, based in California, one of the largest beneficiaries in the AI chip, have dropped almost 17 % of the market value of about $ 600 million, a record for all companies. did.

Deepseek has released the latest major language AI model last week. This has achieved the same performance as our rival Openai performance, despite the fact that the NVIDIA chips were much less.

Venture Capital Investor Mark and Leisen called the new Chinese model “AI’s SPUTNIK MOMENT” and compared the Soviet Union to shock the United States by putting the first satellite in track.

As a result, the investor re -evaluated future investment in AI hardware, and sent a shock wave through the market on Monday.

TECH HEAVY NASDAQ COMPOSITE INDEX has decreased by 3.1 %, and the S & P 500 index has decreased by 1.5 %. Microsoft has decreased by 2.1 %. The trading activities of shares listed in the US S & P 1,500 composite index are a sign of a hurry to interpret how investors will affect Silicon Valley Technical Group, 3 minutes than usual. It was 1 or more.

The route has been extended far beyond the conventional technical name. Siemens Energy, which supplies electric hardware to AI infrastructure, has plummeted by 20 %. Schneider Electric, a French manufacturer of electric power products that invested a lot of data center services, has decreased by 9.5 %.

Trader was a staples company of consumers such as Johnson End Johnson, Coca -Cola, General Mills, and Hercy.

Apple was considered not exposed to AI races more than many large high -tech rivals, earning 3.3 %.

For some people, the sale of companies that made the AI Revolution “Pick and Shavel” reflected the crash of the stock price of the IT hardware company Cisco when the Dotcom bubble burst.

NVIDIA, Broadcom, and other chip manufacturers claim that things like XAI boss Elon Musk and Sam Altman of Openai are needed to continue the AI’s abilities, with the benefits of Silicon Valley racing. I built a fierce cluster of chips.

NVIDIA’s highest executive Officer Jensen Huang and Broadcom’s Hock Tan argue that in recent weeks, the frenzy of data centers will last until the end of 10 years.

Luca Paolini, Chief Strategist of Pictet Asset Management, said:

However, some of the warriers and AI researchers have questioned the hype surrounding the results of Deep Shek. “It seems that” China has duplicated Openai for $ 5 million, “but I don’t think there’s really any further discussion,” says Bernstein’s analyst. I wrote it in the memo.

Some researchers speculate that DeepSeek has been able to take shortcuts at its own training cost by utilizing the latest models of Openai. Pull first.

According to UBS, AI investment by large -scale high -tech companies in the United States reached $ 224 million last year. This is expected to reach $ 280 billion in 2025. Openai and SoftBank announced last week to invest $ 500 million in the next four years on AI infrastructure. 。

Following the latest release of DeepSeek, Meta’s chief Mark Zuckerberg plans to spend up to $ 65 billion on AI infrastructure this year this year.

Deepseek, established by hedge fund manager Liang Wenfeng, has released a detailed paper last week to build a large -scale language model that can be automatically learned and improved.

“It seems that there is a little reality that China is not sitting in an idol, despite these tariffs and investment restrictions on high -tech companies,” said the Macro and foreign exchange of Macro and foreign exchange in Asian emerging markets. Asian head of Mitur Koteca said. Strategy at Barclays.

The United States has imposed strict restrictions on exporting chips to China under former President Joe Biden, and has banned NVIDIA’s most advanced models.

Recommendation

Some analyst argued that the advancement of DeepSeek would ultimately prove that it would be positive for AI chip manufacturers such as NVIDIA.

Dylan Patel, Chief Analyst for CHIP CONSULTANCY SEMIANALYSIS, stated that it would be easier and cheaper for companies and consumers in the long term to reduce the cost of training and AI models.

“With the advances in training and inference efficiency, further scaling and proliferation of AI will be possible,” said Patel. “This phenomenon has occurred in the semiconductor industry for decades. Moore’s law has promoted half of the cost every two years, the industry has continued to grow and adds more to chips.”

George Steer, Jennifer Hughes, Harriet Clarfeld, New York Will Schmidt, Hong Kong Aljun Neil Alim, Tokyo, Leo Luis, Beijing, London’s Tim Brad Show, London, Ian Smith by Ian Smith Report