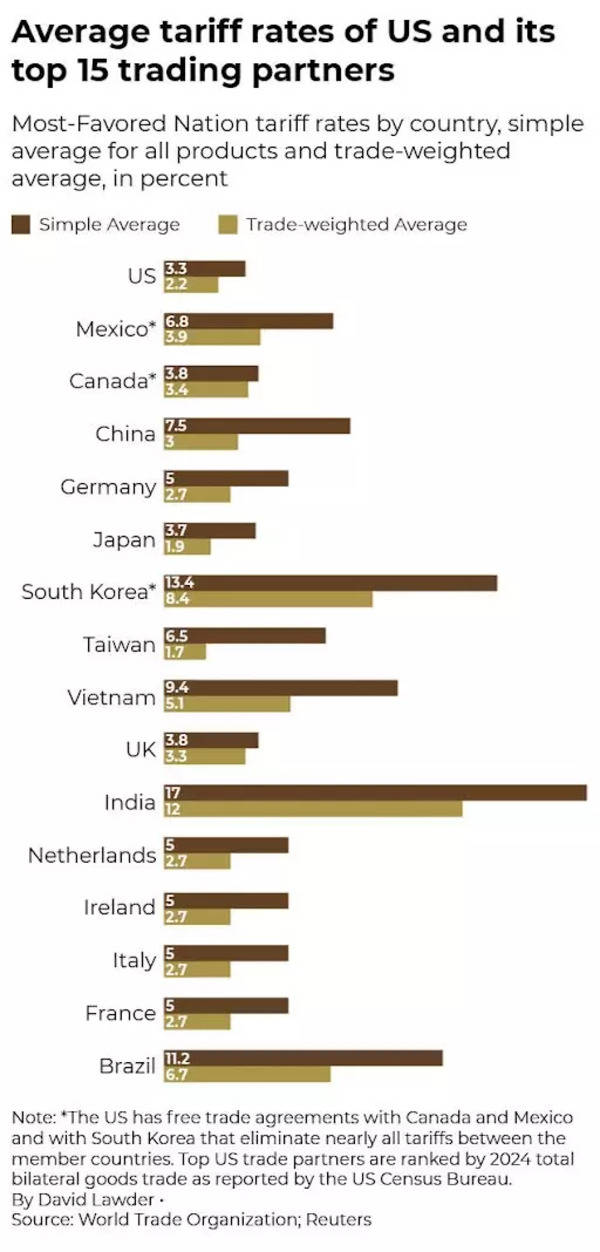

President Donald Trump signed an order on February 13th instructing his administration to propose “mutual tariffs” to US trading partners. The expected tariffs by April are aimed to coincide or offset the tariffs and other trade barriers imposed by foreigners on US goods.

Drive news

Trump’s candidate for Commerce Secretary of Commerce Howard Lutnick said his team is working to finalize details with tariffs expected to be ready by April 2nd. .trump’s move follows his campaign promise to crack down on what he considers as unfair trade practices by other countries. He has long criticised states, including allies such as India, Japan and the European Union, but while benefiting from US duties, he places high tariffs on American products.

Understand mutual tariffs

In trade terms, “mutual” tariffs usually refer to policies in which the state ensures that similar collections are imposed on each other’s goods, aiming to fair trade relations. Historically, trade interactions have often meant mutual reductions in trade barriers to promote economic growth and global integration. For example, the 1934 US Mutual Trade Agreement Act marked a shift away from American protectionism, allowing the US and its trading partners to negotiate lower tariffs on each other’s products.

However, the Trump administration sees the current global trade environment differently. Many US trading partners claim that they maintain policies that are disadvantaged to American businesses through high tariffs, non-tariff barriers, or other regulatory practices. The administration argues that these policies unfairly benefit foreign exporters and put American manufacturers at a disadvantage.

During Trump’s first term, Commerce Secretary Wilbur Ross raised the idea of matching US tariffs with those of its trading partners. Under this “ideal” trading system, the US will only lower tariffs if other countries do the same. The newly proposed mutual tariffs are expected to operate in line with these policies, but there is a broader range and will include non-tariff barriers such as value-added tax (VAT), exchange rate manipulation, and industrial subsidies. I’m taking it into consideration.

The days when America was used are over are over. The plan will put American workers first, improve competitiveness in all sectors of the industry, reduce trade deficits, and strengthen economic and national security.

White House fact sheet on “fair and mutual planning” for Trump’s trade

How do mutual tariffs work?

Unlike the blanket tariffs Trump previously thought, mutual tariffs are adjusted by country. According to a White House memo distributed to trade officials, the policy explains several factors beyond simple tariff comparisons. It aims to offset:

Tariff imbalance: If a country imposes high tariffs on US imports, the US will match taxes on goods from that country. Non-Tarif barriers: include government subsidies, foreign companies, VAT, and strict regulations that artificially artificially put exchange rate policies at a disadvantage. Reduce export costs. Sector-specific adjustments: Tariffs may apply as the overall rate of imports from individual products, industries, or specific countries. For example, Brazil currently imposes an 18% tariff on US ethanol imports, while the US imposes US imports. Brazilian ethanol is rarely tax-free. Under the new policy, Washington could raise its own tariffs on Brazilian ethanol or put Brazilian pressure on it. Similarly, the European Union has charged 10% tariffs on vehicle imports compared to 2.5% in the US, urging Trump to label EU trade policies as “absolutely brutal.”

Why is it important?

Mutual tariff policies are expected to have a broad impact on global trade, particularly in emerging economies with high tariff rates, such as India. It is intended to level the playing field, but for India, which enjoys US trade surplus, it could also lead to US inflation rates and economic slowdowns in the affected countries. , in particular, industries such as drugs, textiles and information technology, which rely heavily on the US market, lead to heavy retaliation tariffs from India, and a tough trade war that could hurt both economies. Trade barriers that could lead to long-term changes in economic policy. Trump’s order also takes into account non-tariff barriers such as value-added tax (VAT), regulatory policies and currency exchange rates, which could further complicate trade negotiations.

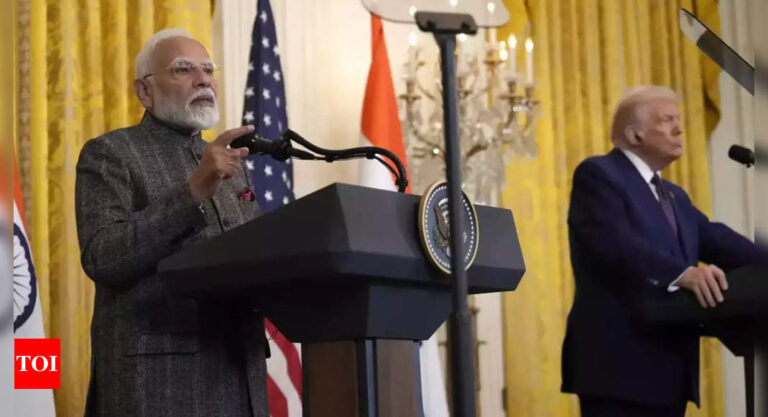

India is the highest tariff nation in the world…it’s difficult to sell to India due to very strong tariffs…Even if India charges, we charge them.

US President Donald Trump

The whole picture

The US-India trade relationship is currently worth more than $190 billion a year, with India’s favorable $50 billion surplus. rate. Under the new policy, customs duties may be adjusted by country and product by country and product. This means that Indian goods could face increased duties based on existing disparities. According to economic think tank GTRI on Friday, the Global Trade Research Initiative (GTRI) is saying that, in order to have a major impact on India due to differences in export profiles, the Global Trade Research Initiative (GTRI) will be saying that if the US is leviing mutual tariffs on Indian pistachios of 50%, An example was provided. India does the same thing and it will have little effect as India does not export pistachios. Farzamore, founder of GTRI, Ajay Srivastava, said 75% of 75% exports to the US remain below 5%. U.S. tariffs on many labor-intensive goods such as textiles, clothing, footwear, etc., at a fee ranging from 15-35% for some products,” he added. In the new Trump era, India may wait for the US decision to see mutual tariffs in April and then respond with equal measures, as it did in June 2019,” Srivastava said. .

The tariffs for the most favorable countries (MFN) of the US average application on agricultural products are 5%. However, the average MFN tariff in India is 39%. India also charges 100% tariffs on US motorcycles, but only 2.4% tariffs on Indian motorcycles.

White House fact sheet on “fair and mutual planning” for Trump’s trade

How does that affect India?

The impact of Trump’s mutual tariffs on India will be determined by how far the US will move in adjusting its obligations and how India will respond.

1. Risk Indian Industry

Pharmaceuticals: India is a major exporter of generic drugs to the US, and higher tariffs could reduce the competitiveness of Indian drugs in the US market. Increased obligations can disrupt supply chains and affect Indian manufacturers. Information Technology: The Indian IT sector relies on the US for business contracts. Reuters report that India’s small steel mills could end up with businesses being scrapped due to a further surge in imports due to a sharp increase in tariffs imposed by Trump, industry executives warned. “We’re excited to introduce a wide range of products,” said Anubhav Kathuria, managing director of stainless steel producer Synergy Steels. The safeguard said senior steel company executives who didn’t want to be identified because they were not allowed to speak to the media.

2. The battle between trade deficits and tariffs

India has a trade surplus of about $50 billion with the US. In other words, they are exported to the United States rather than imports. Trump has repeatedly criticised the imbalance, claiming it reflects unfair trade practices.

India has already taken steps to alleviate tensions such as:

Harley-Davidson motorcycles to reduce tariffs in long-standing Trump complaints. Trump’s new policies could force India to make deeper concessions and risk losing access to the US market.

3. Possible retaliation from India

If the US places a higher obligation on Indian goods, India can retaliate with anti-crimes in relation to American exports. This may have an impact:

US agricultural products such as energy exports, including oil and gas. India is the leading buyer of US energy, and trade disputes can disrupt contracts. Currency and defense transactions, including the purchase of Boeing aircraft and military equipment. However, if Trump’s policies disproportionately hurt Indian businesses, there could be pressure on Modi government to respond.

Leaders welcomed early steps to demonstrate mutual commitment to addressing bilateral trade barriers. The US welcomes India’s recent measures to lower tariffs on US products that are interested in bourbon, motorcycles, ICT products and metal regions, and markets for US agricultural products such as alfalfahey, duck meat, and medical care. Measures to enhance access were welcomed. device. India also expressed its appreciation for the US measures taken to strengthen the exports of Indian mango and pomegranate to the US. The two sides also pledged to work together to strengthen bilateral trade by increasing US exports of industrial products to India and increasing Indian exports of labor-intensive manufactured products to the US. The two sides will also cooperate to increase agricultural trade.

India-US Joint Statement

Between the lines

Trump’s tariff movements are just as much about domestic politics as they are trade. By pushing for more stringent tariffs, he appeals to the American manufacturing and agriculture sector. He considers it to be crucial to his reelection strategy. With growing relations with the European Union, the Middle East and Southeast Asia, New Delhi may be seeking new trade agreements to offset US pressure. China’s Factor: Trump’s tariffs have historically focused on China, but expanding to other countries demonstrates a broader agenda of protectionism. . India needs to navigate this carefully and balance its own trade policy while maintaining strong US ties.

What’s next?

Trump’s tariff strategy could go in several directions: negotiations and compromise: India and the US can lower tariffs on both sides and prevent a full-scale trade war. Gradual escalation: India may respond selectively when the US raises obligations. Targeting politically sensitive sectors to drive better deals. Restructuring of Operating Trade: If tensions continue, India can explore alternative markets to reduce US reliance on trade. India’s diplomatic approach is important. Concessions.

(Includes input from the agent)