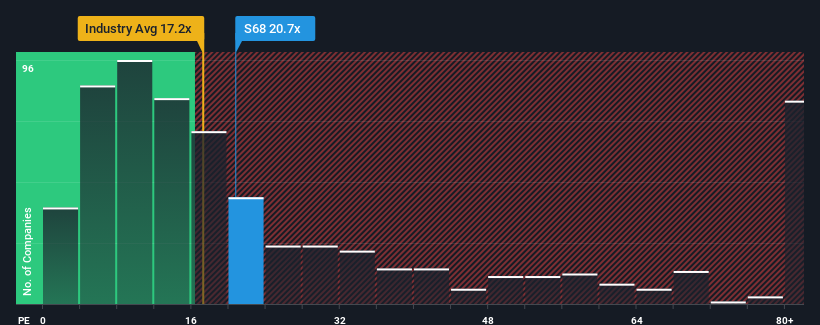

If nearly half of Singaporean companies have a price return rate (or “P/E”) of less than 12 times, then stock and simplify the 20.7XP/E completely avoiding Singapore Exchange Limited (SGX: S68) You can see it. ratio. However, P/E can be very high for reasons and further investigation is needed to determine whether it is justified.

The Singapore Exchange has been doing a good job these days as it has increased revenues over most other companies. Many seem to expect strong revenue performance to last, and P/E has risen. You really hope so, otherwise you’re paying a rather large price for no particular reason.

See the latest analysis of Singapore Exchange

If you’d like to see what analysts are forecasting in the future, check out our free Singapore Exchange report.

Is there enough growth in the Singapore Exchange?

The P/E ratio for the Singapore Exchange is typical for companies that are expected to produce very strong growth, and, importantly, it is far superior to the market.

Looking at revenue growth last year, the company posted a massive 16% increase. The recent strong performance means that we have been able to increase our EPS by 55% in the last three years. So it’s safe to say that recent revenue growth is great for the company.

Looking at the outlook, the next three years should generate 3.0% annual growth, as analysts estimate, as they look at the company. The company is positioned as weak revenue results as the market is projected to bring about 9.9% annual growth.

In light of this, we are wary that Singapore Exchange’s P/E is above the majority of other companies. While most investors seem to want to shift the company’s business outlook, a cohort of analysts is not sure this will happen. It is the boldest to assume that these prices are sustainable, as this level of revenue growth is likely to ultimately weigh heavily on the stock price.

What can I learn from the P/E of the Singapore Exchange?

Prices and return rates are claimed to be inferior measures of value in a given industry, but they can be a powerful business sentiment indicator.

The Singapore Exchange has established that it is currently trading at a much higher P/E than expected, as forecast growth is lower than the broader market. For now, we are increasingly uncomfortable with high P/E, as forecast future revenues are unlikely to support such positive sentiments for a long time. Unless these conditions improve significantly, it is very difficult to accept these prices as reasonable.

Many potential risks can sit within the company’s balance sheet. Free Balance Sheet Analysis for Singapore Exchange allows you to discover risks that can be of concern with six simple checks.

Of course, you may be able to find a better stock than a Singapore exchange. So you might want to see this free collection of other companies with a reasonable P/E ratio and have grown their revenues strongly.

New: Manage all your stock portfolios in one place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

Connect unlimited number of portfolios and check totals in one currency

•Announce new warning signs or risks via email or mobile

•Track the fair value of your inventory

Try our demo portfolio for free

Do you have feedback in this article? Are you worried about the content? Please contact us directly. Alternatively, please email Editorial-Team (at) SimplyWallst.com.

This article simply by Wall Street is inherently common. We provide commentary based on historical data and analyst forecasts, and use impartial methodologies, and our articles are not intended for financial advice. It is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. We aim to deliver long-term intensive analysis driven by basic data. Please note that the analysis may not take into account the latest price-sensitive company announcements and qualitative material. Simply put, the Wall ST has no position in the stock mentioned.