US President Donald Trump has agreed to suspend tariffs planned in Canada and Mexico for at least 30 days after consultations with leaders from both countries. Previously, senior Canadian officials said Trump’s 25% tariff on most Canadian goods was expected to come into effect on February 4th.

If implemented, the tariffs will have significant economic consequences on both sides of the border as the US and Canada share one of the world’s largest bilateral trade ties.

A key concern is the highly integrated supply chain between the two countries. Many products cross borders multiple times as intermediate inputs before becoming the final product. Impacting tariffs at any point in this supply chain will increase the cost of production for a wide range of goods traded between the US and Canada, and will increase prices.

In Canada, tariffs on Canadian products have a significant impact on Canada’s competitiveness in the US market by increasing prices. Such tariffs could pose serious challenges to various Canadian sectors given the country’s strong dependence on the US economy.

Impact on various sectors

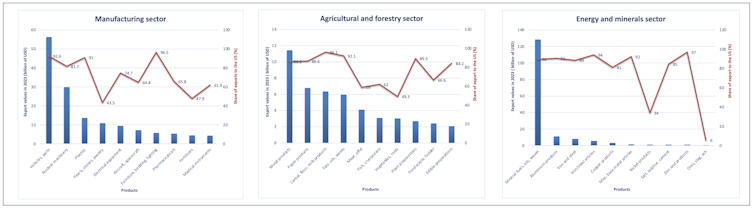

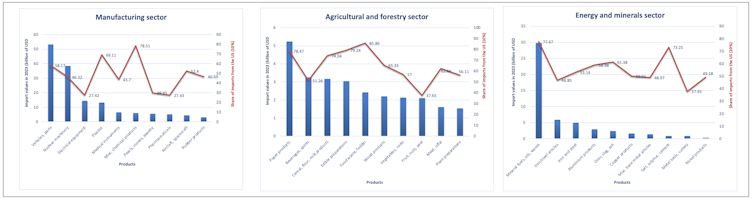

The impact of US tariffs on Canadian prices may vary across sectors and products depending on their dependence on the US market.

Sectors that rely on US trade can experience more severe disruption. If tariffs make certain products uncompetitive, Canadian producers may struggle to secure alternative markets in the short term.

Industries such as agriculture, manufacturing, and energy experience varying degrees of impact. Energy products and cars representing Canada’s largest exports to the US are expected to be one of the most negatively affected.

(World Integrated Trade Solutions)

In the agriculture and forestry sector, according to data from World Integrated Trade Solutions, in the agriculture and forestry sector, it is one of the largest exports of grains and grains to the US, with the US accounting for 86-96% of these exports. It’s there.

In the energy and mineral sector, crude oil is Canada’s highest export, reaching USD 143 billion in 2023, with 90% becoming Canada’s biggest export, with 90% being the 90% being the US It’s not surprising that Trump pointed out crude oil because it was doomed. Oil has a lower tariff of 10%.

Canada’s dependence on US trade

When examining the impact on various products, it is not only the value of trade, but also the proportion of trade that matters. The percentage of trade shows how much Canada is dependent on the US compared to other markets.

Canada relies heavily on the US market for its products, so high trading companies with the US suggest that their products are particularly vulnerable to trade disruptions. Conversely, a lower share indicates Canada is diversifying its suppliers, which reduces its dependence on the US

Read more: Trump’s tariff threat may shake North American trade ties and support agricultural food trade

For example, in 2023, Canada’s top exports to the US included vehicles and parts, nuclear machinery and plastic, according to data from World Integrated Trade Solutions. The US accounted for 93% of vehicle and parts exports, 82% of nuclear machinery exports and 91% of plastic exports.

The data highlights Canada’s extreme reliance on the US market, making these industries within the manufacturing sector highly susceptible to tariffs. This could harm the employment of the manufacturing sector, which is essential for employment in Canada, and provide employment to more than 1.8 million people.

Canada’s dependence on the US is also dependent on imports. In 2023, vehicle imports totaled US$92 billion, with the US accounting for 58% of that amount.

(World Integrated Trade Solutions)

Dependence is also evident in the agri-food and forestry sector, where Canada relies heavily on US imports. This suggests that retaliatory tariffs on agricultural products from the US could have a major impact on Canadian food prices.

Retaliation tariffs and inflation pressures

Canada has announced that it is inflicting retaliatory tariffs of $155 billion on US imports accordingly. This could contribute to inflationary pressures within Canada.

Prime Minister Justin Trudeau said this included immediate tariffs on goods worth $30 billion as of Tuesday, followed by tariffs on American goods worth $125 billion over the next 21 days. Masu.

This includes “major consumer products such as home appliances, furniture, sports and other everyday items such as American beer, wine and bourbon, fruit juices such as orange juice and fruit juices, vegetables, perfumes, clothing, shoes, and more. includes customs duties regarding equipment, and materials such as wood and plastic.

Given Canada’s heavily reliant on US imports, retaliation fees increase the costs of American goods entering the country, further increase consumer prices and exacerbate inflation.

In its latest policy rate announcement, the Bank of Canada warned of the serious economic impact of Trump’s tariffs, highlighting the possibility of reverse the current downward trend inflation.

Canadian Press/Chris Young

What should Canada do now?

Canada must expand its economic diplomacy efforts beyond the Trump administration, engage with the US Congress and the Senate, and advocate for a reexamination of tariffs on Canadian goods. The Canadian government must stick to using this channel to drive tariff reversal. This kind of broader negotiation remains the most effective approach to alleviate trade tensions and ensure stable economic ties with the US.

At the same time, Canada needs to reduce its dependence on the US market by adopting a comprehensive export diversification strategy. While the US remains a convenient and accessible trading partner, expansion into emerging and developing markets will help reduce risk and create more stable long-term trade opportunities.

Read more: Trump’s tariff threat is a sign that Canada should diversify beyond the US

One effective way to achieve diversification of exports is to expand free trade agreements (FTAs) with emerging economies and developing countries. Currently, Canada has 15 FTAs covering around 51 countries, but there is room for expansion. However, signing an FTA alone is not sufficient. Canada must ensure that these contracts are converted into concrete trade growth with partner countries.

International politics is increasingly shaping world trade, and it is essential for Canada to actively manage diplomatic and trade relations. Tensions have been rising in recent years among key partners such as China, India and Saudi Arabia. All of these countries could become potential markets for Canadian products. Given that China is Canada’s second largest export destination, it could be important to expand trade ties.

Furthermore, countries like the United Arab Emirates present promising markets, particularly in agricultural products. This is because the UAE imports about 90% of its food.

(AP Photo/Ben Cartis)

Innovation and productivity improvements

Canada is at a critical time in its trade relations with the US, but diplomatic efforts are essential to avoid harmful tariffs, and they cannot become the country’s only line of defense.

Increased productivity is one of the most effective ways for Canada to improve its competitiveness in the global market. Canadian producers are looking to expand beyond the US, and therefore need to prioritize innovation and adoption of advanced technologies to increase efficiency and remain competitive.

In response to potential US tariffs, the Canadian government should implement relief strategies to provide short-term relief and reduce revenue losses to mostly affected businesses. Additionally, Canada needs to leverage embassies and consulates around the world to promote exports and help affected businesses identify and access new market opportunities.

By doing this, Canada can establish itself as a more independent and competitive player in the global economy.