(Bloomberg) -Last year, the strategy of issuing federal debt was repeatedly exploded after repeating Janet Jeren and then calling for sales of the Ministry of Finance reached Scott Bessent. The planned Wednesday.

With the so -called quarterly refund plan in the past, the Ministry of Finance hopes to increase the issuance of securities longer than “at least for the next quarterly” after the final bumping at the last start. I advised me. year. Many dealers believe that some of the things that have been changed for past comments from Basent can potentially sow water in a quarter of “several people” or “couples”. Masu.

Former Hedge Fund managers were accused of Jeren who was artificially reduced sales that would affect mortgage rates, before President Donald Trump was selected as Jeren’s successor. He was one of. Economic before the election. He criticized the prior notice of the refund statement in August as “for the first time.”

“This will be an important point for Wednesday statements,” said Mark Kabana, a Bank of America Corp Head of US rate strategy. guidance. “”

After taking office last Tuesday, Bessent, who has not yet built a team, has a possibility that the number of long -term Finance will decrease in anticipation of the increase in supply if the guidance is completely deleted. I warned. Many languages are now retained, but many are considered a close call.

One issue is that the Long -term Finance yield has jumped in most of the percentage points since September. This is a concern about the budget deficit and inflation, and the concerns of the planning of Trump to raise taxes and raise tariffs. The refund will take place this week, as it is set to kick in along the bow in Canada, Mexico, and China, so this week is a special uncertainty about prices.

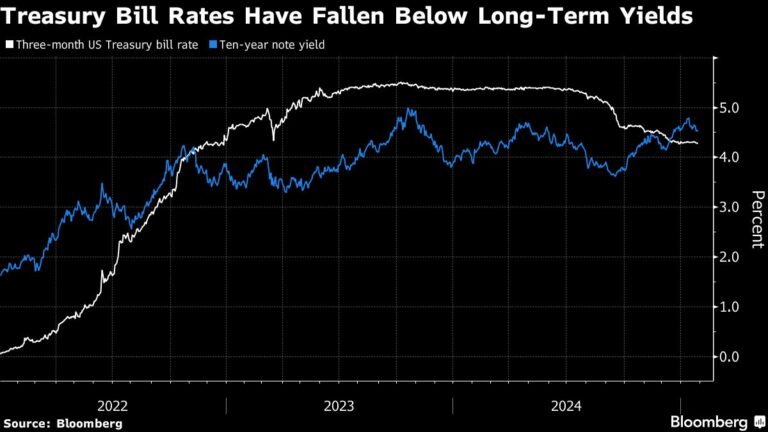

At the end of Friday, the 10 -year banknotes are far beyond 20 Basis points than the invoice, which is mature in a maximum of one year, costs more for the Ministry of Finance, and increases sales over the long term. I raised the stock.

“It’s a very different world than when Yellen decided to lean on the bill in 2023,” said Jason Williams, a strategist of Citibun Group. The current case and the absolute level of yield are also higher. Even if Bessent wants to extend the weight of the US debt, he will want to do it slowly and in a neat way. “

After a series of increases, which began in August 2023, the Ministry of Finance maintained a quarterly refund auction. Even a relatively modest change in size can affect the market. After the boost in August 2023, the yield rose, which triggered the movement in November 2023, which reduced the issue of long -date debts.

Considering the spread of US budget deficits, the amount of debt that the Ministry of Finance must sell continues to rise, and the dealers say that at some point, the increase in sales of long -term maturity is inevitable. The Ministry of Finance on Monday will release the latest information on more widespread borrowing needs and cash balance.

JPMORGAN CHASE & CO. , Citigroup, Santander, and Society Generale are one of the companies that Bessent is now looking for his predecessor guidance. Nevertheless, consensus between dealers means that long -term debt issuance will not actually move high until refunds in November.

Bank of American cabana believes that guidance can be completely eliminated. As a result, some investors may lead to an increase in sales as soon as the refund is refunded.

BoFA’s Katie Craig, along with Cabana, has begun investigating the demand of investors to the Borrow Advisory Committee of the Ministry of Finance, a panel of bond market participants, to have a long -term debt. I wrote a note on the client to expect to ask. sale.

FRB

Politics in this issue accused Trump’s paper by Steven Milan, an economist, nominated for Trump to lead the White House Economic Advisory Council, and the Ministry of Finance of the Ministry of Finance. And came to the front by Noriel Rubini. Jeren refused the idea firmly, and one of her top EU gave a detailed speech to counter “misunderstanding.”

Meanwhile, there are other considerations, such as uncertainty about the time when the Federal Reserve steadily reduces the ownership of the Ministry of Finance. Last week, the chairman Jerome Powell did not provide hints about the time when it might end in step, but when it was gradually abolished, it was necessary by the Ministry of Finance. You will reduce the amount. The Ministry of Finance specifically asked a dealer in a quarterly survey on a quarter survey of the Fed’s balance sheet policy.

In addition to the advanced uncertainty about the financial outlook, “these are two major factors that make the decision -making process a little more complicated, and claim that there are fewer commitments on Wednesday Wednesday.” William Marshall, the Goldman’s head, said he had set a strategy. “There is a cost to provide guidance and do not follow.”

If you maintain the current situation of the issue, a refund auction will be held on the course next week.

3 years of $ 58 billion on February 11th

10 years of 10 years of $ 42 billion on February 12

30 -year bonds of $ 25 billion on February 13

The Ministry of Finance on Wednesday has also continued to change the issuance of fluctuating interest rates, and continues to increase the sale of securities or hints protected by the Ministry of Finance.

Another complexity of Basent is to manage the world’s largest bond market under the restrictions of federal debt restrictions that returned early in January. The episode drawn by the parliament raised or stopped, forced the Ministry of Finance to reduce the issuance of the bill and pay for cash.

“Bessent is a kind of solution, and after a debt restrictions, they may probably start to pierce for a long -term issue,” said BLAKE GWINN of RBC Capital Markets. “So this meeting may be a kind of laundry.”

Unless you have seen the Trump administration running more than 6 % of GDP for the next few years, a larger auction is approaching. Pacific Investment Management Co., Ltd.’s non -traditional strategy “It suggests that there should be a larger risk premium, a larger long -term debt, a premium, and a more steep yield curve.”

Jean Boivin, head of BlackRock Investment Institute, expects the current yield to more than 5 % to more than 5 %. Although the administration’s specific plan is highly uncertain, “tax reduction will definitely continue the deficit trajectory.”

Most read from Bloomberg BusinessWeek

© 2025 Bloomberg LP