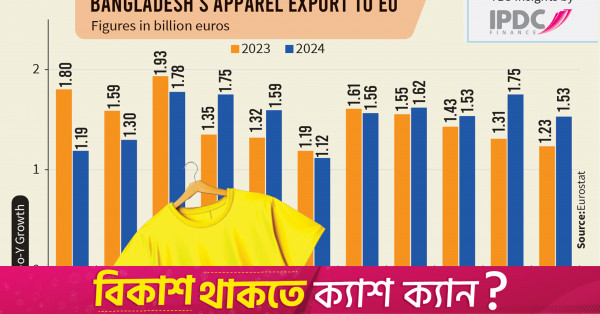

Bangladesh’s apparel exports to the European Union increased by 24.09%, reaching 1.53 billion euros ($1.57 billion) in November last year, mainly due to easing inflation and lower interest rates in Western countries.

Data from Eurostat, the 27-nation statistics agency, showed apparel shipments rose consistently in the four months to November due to increased demand in the European market.

In the first 11 months of 2024, six months recorded positive growth, including four months with double-digit increases from over 20% to nearly 34%, while the remaining five months saw apparel exports increase. There was negative growth.

Driven by increased demand, apparel shipments to Bangladesh’s largest single destination increased by 2.53% from January to November, outpacing the global average increase of 0.34%.

Exports for the four-month period amounted to 16.72 billion euros, up from 16.31 billion euros in the same period in 2023. Exports of knitwear increased by 0.89% to 10.05 billion euros, while the textile sector saw a significant increase of 5.13% from 6.35 euros. 1 billion to 6.67 billion euros, according to Eurostat.

Apparel exporters attribute this growth to easing inflation and lower interest rates in Western countries, particularly in the European Union, which boosted global demand for apparel. He also noted that orders for high value-added products from Bangladesh are increasing.

Exporters also expressed optimism about the steady flow of orders, adding that improved law and order could attract more global companies to Bangladesh.

The strong recovery from August to November 2024 was driven by increased demand during the EU retail peak season.

Abdullah Hil Rakib, managing director of Team Group, said in an interview with Business Standard that the growth in EU apparel imports is tied to the economic recovery from the effects of the ongoing war and inflation. Ta.

He assessed that the growth in Bangladesh’s apparel exports to the 27 Knighton Trade Zone was due to several factors, including the shift of some orders from China due to trade tensions, which benefited Bangladesh. .

Mr. Rakib expressed optimism that this momentum can be maintained in the coming months if the government ensures adequate power and energy supplies along with appropriate policy support.

He called on the government to prioritize law and order, noting that extortion in many industrial sectors poses a serious challenge for businesses.

The entrepreneur expressed concern about recent proposals for an increase in energy prices and a possible increase in labor wages, and warned of the impact on exporters.

Rakib, who is also a former senior vice-chairman of the Bangladesh Garment Exporters Association, said: “If the government does not revise these proposals, the overall cost of production will increase and our competitiveness in the global market will further decline.” Deaf,” he said.

Bangladesh remains the second largest RMG exporter to the EU

According to Eurostat data, total apparel imports by EU countries from the world market in the first 11 months of 2024 increased slightly by 0.34% to 78.6 billion euros, compared to 78.33 billion euros in the same period last year. reached.

Bangladesh continues to be the second-largest apparel exporter to the EU after China, supported by growing focus on cost-effectiveness and sustainability, exporters said.

China maintained its top position, with exports in the first 11 months of 2023 increasing by 1.19% to 22.11 billion euros from 21.85 billion euros.

China’s knitwear exports to the EU increased by 3.67%, but shipments of woven clothing decreased slightly by 1.31%.

From January to November, the EU’s apparel imports from Turkey amounted to 8.6 billion euros, down 6.99% from 9.24 billion euros in the same period last year.

EU apparel imports from India increased by 0.70% to EUR 3.91 billion compared to EUR 3.88 billion in the same period last year.

Vietnam’s apparel exports to the EU increased by 2.87% to 3.63 billion euros from 3.53 billion euros in the previous year.

Cambodia and Pakistan emerged as the top performers for ready-made garment exports to the EU in the January-November period, driven by strong growth in the knitwear and textile sectors.

The EU’s apparel imports from Cambodia increased by 19.94% to €3.58 billion, compared to €2.99 billion in the first 11 months of last year.

Pakistan’s apparel exports to the EU increased by 11.16% to EUR 3.2 billion from EUR 2.88 billion in the same period last year.