Company-specific export data allows researchers to potentially solve economics puzzles

Japan has a new appeal that is appealing to tourists. The country attracted a record 36.9 million visitors in 2024 and was attracted by the yen, which lost half its value to the US dollar since the second half of 2020. This has made Japan a bargain destination for international travelers.

What’s good for tourists may also benefit Japanese businesses. A weaker currencies can make exports cheaper and more attractive overseas. Mitsubishi Heavy Industries, one of Japan’s largest exporters, has seen stocks skyrocketing, while another Toyota Motor Corporation has profited despite a scandal over irregularities in safety certifications that negatively affected sales at home. has risen.

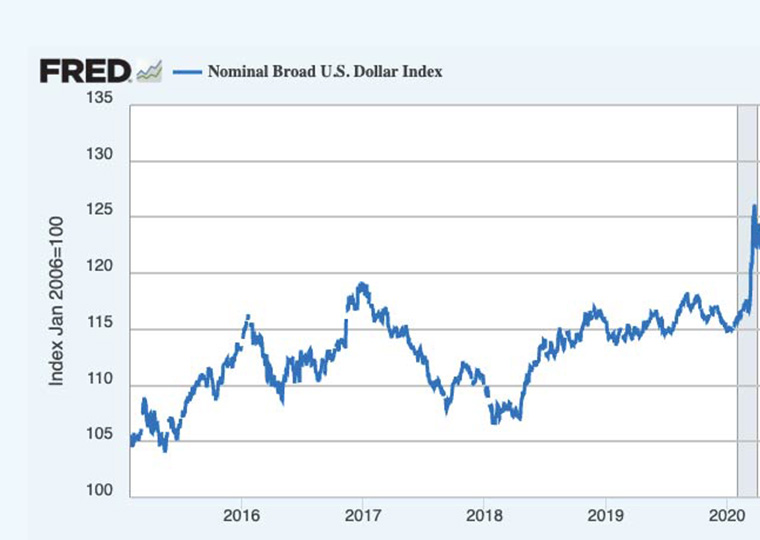

However, past research has struggled to find a strong impact from other currencies on US dollar movement and US stock revenues. This is constructed as a “exposure puzzle with exchange rates.” Given the substantial role of international trade in the US economy, the weak association for economists is surprising given the dramatic fluctuations in exchange rates that occurred between 1999 and 2019. The euro changed between $0.84 and $1.59, with the yen changing from 80 to 360 yen. Dollar. (See the graph above with the heading showing dollars against baskets of other currencies.)

Working paper by UCLA Anderson’s IVO Welch and Hong Kong’s Yuqing Zhou’s China University may finally solve the puzzle. Their work suggests that currency movements have a much greater impact than previously thought, especially recently. In fact, their research suggests that exchange rate movements have a significant impact from 2016 to 2016 during the period studied by US companies.

Company-specific data hones your analysis

The key to their discovery was gaining access to data containing company-specific information about exports. This is a granularity that was lacking in previous research. Without company-specific export data, past researchers’ efforts can be compared to predicting store sales using industry-wide statistics rather than store-based transaction records.

The data that the researchers tap is the Census Bureau’s longitudinal foreign trade transaction database, providing transaction-level data for all physical exports, including corporate export records. This data includes destination, dollar value, and product details.

Welch and Zhou combine LFTTD data with historical exchange rate information from the International Monetary Fund and financial performance metrics from Compustat and CRSP databases to see whether currency changes will be made to the international exports, sales, profits and stock returns of individual companies. We tracked exactly what was affected. This data was used to create company-specific scales.

Researchers’ metric weights vary based on a specific combination of each company’s export destination. This is important. Because one company may export to countries where the dollar is highly valued against the local currency, another company will export to countries where the dollar is mostly weakened against the local currency. Because it may be. They also filtered data from companies in which exports accounted for at least 1% of total sales to ensure that their findings reflected export-dependent companies rather than broader markets.

Currency depreciation offers businesses the advantage of double sales

By taking that action, the researchers analyzed the sensitivity of the exchange rate to companies’ exports, sales, profits and stock returns. Their findings suggest that when the US dollar is weaker than 1% against other countries’ currencies, the US will typically increase by 0.4% and increase by 0.6%. (The effect became even stronger when the company was large or the business was very exported.)

For total sales (international and domestic) of US companies, these increased by 0.6% to 0.8%. The increase in sales reflects more than just a bump in exports, as the company’s local sales increase as it increases as its foreign competitors’ products become more expensive as they strengthen against the US dollar.

The researcher’s analysis also suggests that a 1% depreciation of the US dollar would increase both the profitability and stock returns by 0.2%. Researchers found that these effects become stronger for export, sales and profitability as global trade increases and global markets become more integrated. From 2004 to 2016, the impact was approximately 50% greater than the early years of the sample data.

However, the sensitivity of inventory returns to exchange rate movements has not increased. This may be because investors have become more proficient at predicting the impact of currency movements on companies. Markets are priced efficiently through the influence of these currencies.

Welch and Zhou said that increased corporate exposure to currency movements could “expose them to exchange rate intervention by foreign and domestic domestic reserve banks.” Additionally, while some companies have hedged currency risks, the study shows that currency movements still have a significant impact on the final outcome. This is why the impact was not seen in stock returns, as it contradicts previous researchers’ suggestions that companies have completely escaped the effects of currency.

This study shows that currency movements are more important than previously thought. The effect can overcome multiple aspects of business performance, especially for large companies and large international sales.