The Indian stock market experienced another week of volatility, but was able to settle with marginal profits driven by mixed global and domestic factors. The Budget 2025 Announcement, the Reserve Bank of India (RBI)’s first monetary policy in 2025, the Delhi election 2025, and the US trade tariff announcement were the main themes that decided the market movement last week.

Investors will then monitor the triggers of key markets in the second week of February, and the market will enter in the second month of 2025. Next 5 days.

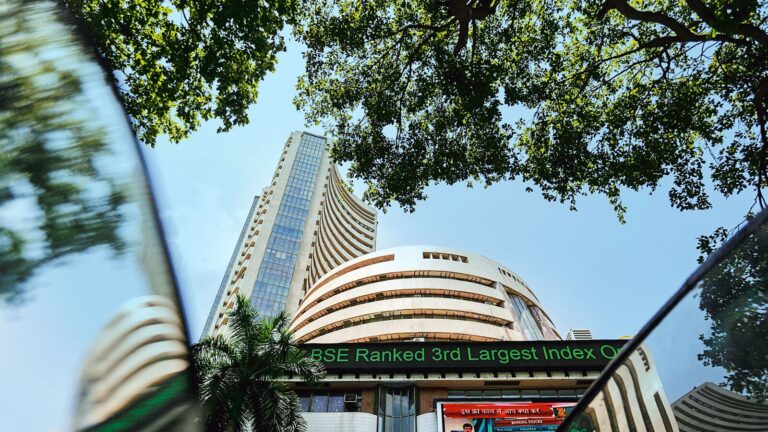

The domestic equity benchmark has continued its upward momentum for two consecutive weeks, with the Nifty 50 increasing 0.33% to close at 23,559.95, and BSE Sensex rising 0.46% to settle at 77,860.

The central bank’s Monetary Policy Committee (MPC), led by RBI Governor Sanjay Malhotra, has cut its reporate by 6.25% on 25 basis points. This was the first cut since May 2020 and the first revision two and a half years later. Interest rate cuts have failed to encourage investors from central banks who are hoping to increase liquidity.

On Friday, MPC provided widely expected reporate cuts, but the move failed to trigger a significant market response. Positive sentiment will ease global trade worries by improving domestic outlook for the 2025 budget and US President Donald Trump to promote temporary suspension of import duties in Canada and Mexico This has been greatly promoted.

Also Read: RBI Monetary Policy: Are rates reduced to growth drugs to boost demand? Here’s what it means for the Indian economy

Supported by RBI’s expectations of interest rate reduction, interest-sensitive sectors such as banks, finance and automobiles led the initial recovery. “Strength was spotted in metals, IT and pharma stocks, which contributed to the overall positive momentum,” said SVP, Research, Religare Broking Ltd.

Despite the benefits, several factors have thwarted the suppression. “Corporate revenues for the third quarter, permanent rupee depreciation and sustained foreign fund outflows have been heavy in the market,” said Puneet Singhania, Director of Master Trust Group.

This week, major markets witness action in three new early releases (IPOs), with key lists scheduled for the mainboard and across the SME (SME) segment. This week will be important from a national and technical perspective, as investors track domestic and global economic data along with quarterly corporate revenues.

Here are some key triggers for the stock market next week:

Delhi Election Results 2025

The BJP won 48 of Delhi’s 70 Congress seats, comfortably crossing the intermediate mark needed to form a government in Union Territories. D-Street experts say the BJP’s victory in the Delhi election is a major achievement for the distribution of dominance. The sentiment in the Indian market is gradually improving in response to good budgets and MPC rate reductions.

Also Read: Delhi Election Results: How will Indian stock market move after BJP victory? Nifty’s major technical level, Sensex

“This could have a positive impact on the market in the short term. However, Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said:

Domestic macroeconomic data

Market attention is expected to be directed towards weekly scheduled macroeconomic indicators, such as Industrial Production Index (IIP), Consumer Price Index (CPI)-based inflation, and Wholesale Price Index (WPI) inflation.

Also Read: RBI, Finmin Works together. Tax cuts, interest rate reductions to boost demand: FM Sitharaman ahead of new IT invoices

The output data for inflation and industry will be released on February 12th. January inflation is projected at 4.69% year-on-year, lower than the previous CEN, which could affect RBI rate decisions at the April policy review meeting. Industrial production in December is expected to be 4.1% year-on-year at 4.1% compared to 5.2%, indicating a weaker manufacturing momentum.

Q3 Results

Corporate revenues also promote market sentiment. Large companies reporting results for this December quarter include TVS Supply Chain Solutions, Varun Beverages, Crisil, Eicher Motors, Apollo Hospitals, Grasim Industries, Vodafone Idea and Steel Authority of India, Bayer Cropscience, Hindustan Aeronautics , IIFL Finance and Muthoot Finance.

9 New IPO, 6 lists to hit D-Street

In the mainboard segment, Ajax Engineering IPO, Hexaware Technologies IPO, and high quality power IPO will open for subscriptions this week. In the SME segment, six new issues will be open to bidding over the next five days. Among the listings, six small business stocks will debut this week on BSE SME or NSE SME.

FII Activities

Institutional activities indicated net foreign institutional investors (FII) outflows £8,852 crore in the cash segment, offset by an influx of strong domestic institutional investors (DIIs) £6,449 crores, providing stability to the market.

“The strength of the dollar index and high US bond yields continue to force FII sales. Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said:

Also Read: RBI starts its rate cut cycle after a 5-year lull. Will this allow the Nifty 50 to regain the 25k mark?

The sentiment in the Indian stock market is gradually improving in response to good budgets and MPC rate reductions. The BJP’s victory in the Delhi election is a major achievement for the dominant distribution.

“This could have a positive impact on the market in the short term. However, the market medium-long term trends depend on the recovery in GDP growth and revenue recovery,” says Dr. VK Vijayakumar added.

Global Queue

Market outlook is derived from key global economic data released this week. US CPI (JAN), US Core CPI (JAN), US Interiart Jobless Claims, US PPI (MOM) (JAN), US Core PPI (JAN), US Industry Production (JAN), US Retail Sal Macros such as es (JAN) Data), UK GDP data, China CPI (MOM) (JAN) will shape market sentiment over the next five days.

US inflation data for January will be discussed on Wednesday, February 12th. Core inflation is expected to be 3.2% year-on-year, while headline inflation is projected to be 2.9% year-on-year. The surprises of these numbers could have an impact on the future policy stance of the US Federal Reserve.

Later that day, testimony from US Chairman Jerome Powell will be closely monitored for insights into interest rate expectations. On February 13th, UK December GDP growth data will be released. Analysts expect GDP to grow at 0.1% each month.

Also Read: The US federal government holds a steady benchmark rate at 4.25-4.50% in President Trump’s first policy verdict. Five important highlights

By Friday, February 14th, US retail sales data for January is projected to be 0.4% mothers, providing insight into consumer spending. India’s foreign exchange reserves, bank loan growth and trade balance figures have also been released, affecting the rupee and stock market movements.

Apart from these, US dollar bonds, yields on US Treasury, foreign fund outflows, Asian markets, and crude oil prices determine market movements, particularly given President Donald Trump’s tariff policies.

Corporate Behavior

Shares of Hero Motocorp, ITC, Cochin and Shipyard will trade Ex-Dividend next week, among other things. Also, some stocks will trade ex-bonus with ex-split this week. Check out the full list here

Disclaimer: The views and recommendations provided in this analysis are those of the individual analyst or brokerage company, not mint. As market conditions change rapidly and individual situations may differ, consult investors with accredited experts, consider individual risk tolerances, and conduct thorough research before making investment decisions. We highly recommend that you do so.

Catch all the business news, market news, broken news events and latest news updates on Live Mint. Download the Mint News app to stay up to date with the daily market.

morefew