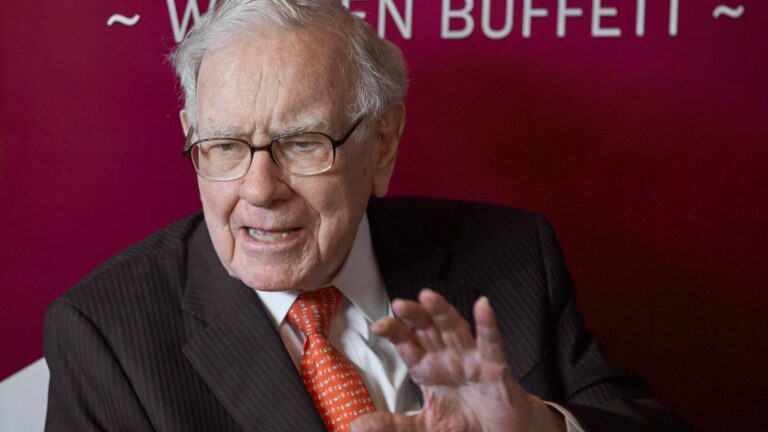

The secret behind the investments that helped make Warren Buffett a huge amount of money is probably not the reason you think.

Every ten years or so, someone declares that the Berkshire Hathaway boss has lost touch. This is usually an affordable stock clue that he likes to come back. Still, Buffett’s mentor Benjamin Graham invested value in the way he practiced it, and the Nobel Prize-winning economist defined it decades later, with too few rebounds recently.

The reason is not because “magnificent seven” stocks, such as Nvidia, Apple, and Tesla, have rewritten the laws of gravity. I gave it that.

The classical value coefficient was explained in 1992 by economists Eugene Fama and Kenneth French in a groundbreaking paper. It was persuasive. Their portfolio of stocks, which are cheaper than their book value, were stolen from flashy stocks by songs that cost thousands of percent points over thousands of points. Decades.

However, the professor’s results covered a period in which the value of a company is mostly in property and machinery, rather than brands or intellectual property. Fifty years ago, less than a fifth of the S&P 500’s assets were intangible. Today it’s well over four-fifths of the time, and many top performance companies like Microsoft are “Asset-Light.”

The results tell us: analysts at fund manager Abbett Lord point out that the book-based portfolio returned 519% from the price, which earned 519% between 2002 and mid-last year. Based on free cash flow yields, more than twice was done.

Free cash flow is generally defined as the money left after expenses and capital expenditures that a company can return to shareholders. Yields are typically calculated by dividing 12 months of free cash flow by the company’s value (market capitalization and net borrowing).

“I got caught up in this about 10 years ago,” says Sean O’Hara, president of Pacer ETFS distributor. Pacer’s US Cash Cow Index supports the ETF of the same name, Cowz, which has about $25 billion in assets. It returns 15.7% per year over five years, making it 7% points better than the Russell 1000 value index. .

If imitation is a sincere form of flattering, the recent popularity of funds seeking to capture similar effects has valued the yield of free cash flow. ETFs launched in 2023 only include tickerflow from Global X, QOWZ from Invesco, cows from Amplify ETFS and VFLO from Victorshares.

Value investment was never dead. There was a problem with the measurement. Many investors, Joel Greenblatt of “Magic Formula” fame, and even Buffett himself, ignore the academic restraint jackets that plague several value indices. However, it improves the results.

Cowz is simple. Its unique index is weighted by 100 free cash flows, choosing the best free cash flow yield of 100 from the Russell 1000 stock index, and then 100 free cash flows with free cash flows that earned 2% of the index. The fund’s yields at the end of 2024 were 7.32% or 4.7 percentage points higher than the overall Russell 1000 index. The smaller company version, calves (please get it?), produced 9.94%.

Does your strategy work during tough times? S&P Dow Jones Indices has built its own free cash flow based index based on the S&P 500. This calculates that between declining economic growth and increasing inflation, the index beats a wide range of markets at the largest margin.

With a strain on Mag 7 stock, Cowz’s top seven cash returners these days – Qualcomm, Gilead Sciences, Cencora, Tenet Healthcare, Valero Energy, Archer-Daniels-Midland, Bristol-Myers Squibb, the most sturdy It has become a replacement.

Call them “negative 7.”

Please write to Spencer Jakab at Spencer.jakab@wsj.com