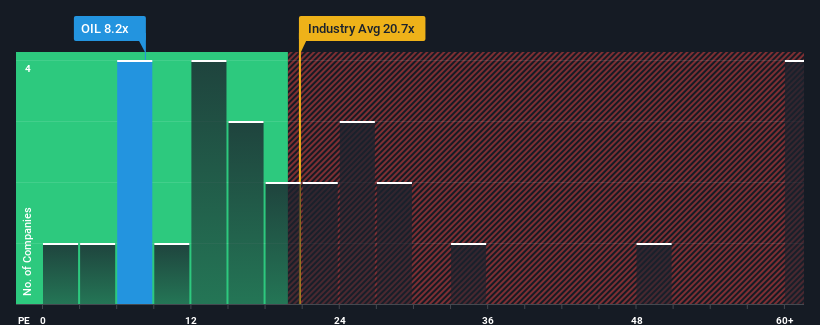

Oil India Limited (NSE:OIL) price-to-earning (or “P/E”) ratio could be 8.2 times. The /e ratio is very common to exceed 30x and exceed P/E by more than 56 times. Nevertheless, we need to dig a little deeper to determine whether there is a reasonable basis for a significant reduction in P/E.

Oil India certainly does a good job these days as it earns more than most other companies. One possibility is that P/E is low as investors think this strong revenue performance is not so impressive going forward. Otherwise, existing shareholders have reason to be very optimistic about the future direction of the stock price.

See the latest analysis of petroleum India

Would you like to find a way for analysts to think Oil India’s future is against the industry? In that case, the free report is the perfect place to start.

How is oil India’s growth leaning?

There is an inherent assumption that companies should fall far below the P/E ratio market like Petroleum India, which is considered reasonable.

Looking at revenue growth last year, the company posted a massive 43% increase. In the latest three years, we have seen an overall excellent increase in EPS of 84%, supporting short-term performance. So you can start by making sure your company does an amazing job of increasing revenue during that time.

Shifting into the future, estimates from 11 analysts covering the company suggest that revenues will increase by 4.0% per year over the next three years. This is shaped to be significantly lower than the broader market’s annual growth forecast of 18%.

In light of this, it is understandable that Oil India’s P/E is below most other companies. Most investors are hoping for limited future growth and seem willing to pay a small amount of money for their stock.

The final words

In general, our preference is to limit the use of prices and rates of return and establish what the market thinks about the overall health of a company.

As we suspected, a survey of the forecasts of petroleum India revealed that its inferior revenue outlook contributes to a low P/E. At this stage, investors feel that the likelihood of profit improvement is not large enough to justify the P/E ratio. Unless these conditions improve, they continue to form a barrier to stock prices around these levels.

Don’t forget there may be other risks. For example, I have identified one warning sign for Oil India.

Of course, you might look at some good candidates and find great investments. So take a peek at this free list of companies with a strong growth track record and trade at low P/E.

New: AI Stock Screener & Alert

Our new AI Stock Screener scans the market every day to reveal opportunities.

•Dividend Powerhouse (yield of 3% or more)

Underrated small cap with insider purchases

High-growth technology and AI companies

Or create your own from over 50 metrics.

Explore now for free

Do you have feedback in this article? Are you worried about the content? Please contact us directly. Alternatively, please email Editorial-Team (at) SimplyWallst.com.

This article simply by Wall Street is inherently common. We provide commentary based on historical data and analyst forecasts, and use impartial methodologies, and our articles are not intended for financial advice. It is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. We aim to deliver long-term intensive analysis driven by basic data. Please note that the analysis may not take into account the latest price-sensitive company announcements and qualitative material. Simply put, the Wall ST has no position in the stock mentioned.