Ahead of TSMC’s earnings announcement on January 16, there are rumors circulating in the market that the foundry giant’s largest customer is cutting orders for CoWoS-S. According to the Commercial Times, AMD and Broadcom will release previously reserved CoWoS-S capacity due to slowing demand, while NVIDIA will move CoWoS-S orders to its more advanced CoWoS-L technology. It is reported that there is a trend.

Will CoWoS-S orders decrease significantly?

Another Economic Daily report states that NVIDIA may reduce CoWoS-S orders from TSMC and UMC by up to 80%, which could reduce TSMC’s revenue by an estimated 1% to 2%. I’m warning you. According to the report, the decline in orders can be attributed to the discontinuation of NVIDIA’s Hopper platform, limited demand for the new GB200A, and relatively slow market demand for the GB300A.

However, the Commercial Times notes that the overall demand for TSMC’s CoWoS technology remains unchanged, with NVIDIA’s GB300A expected to ramp up gradually in the second half of 2025.

Jensen Huang’s visit to Taiwan: CoWoS in the spotlight

Notably, NVIDIA CEO Jensen Huang is heading to Asia after completing his schedule at CES 2025. In addition to attending NVIDIA’s year-end party in Taiwan, Huang also plans to meet with key supply chain partners including TSMC and ASE Group subsidiary SPIL to negotiate CoWoS capacity, according to the Commercial Times .

Looking ahead to 2025, NVIDIA plans to strategically promote its B300 and GB300 lines that utilize CoWoS-L technology, thereby driving demand for advanced packaging solutions, according to TrendForce.

As noted by TrendForce, the B300 series will launch between Q2 and Q3 of 2025, while the B200 and GB200 will start shipping between Q4 of 2024 and Q1 of 2025. is.

TSMC’s CoWoS Enhancement Update at Innulox Factory

Undeterred by market rumors, TSMC is reportedly moving forward with expanding CoWoS capacity. According to the Commercial Times, after acquiring Innolux’s factory in southern Taiwan, TSMC plans to prioritize expansion of CoWoS-L to meet customer demand. Industry sources say the facility was originally planned to have a CoWoS-S line, but will now focus on CoWoS-L.

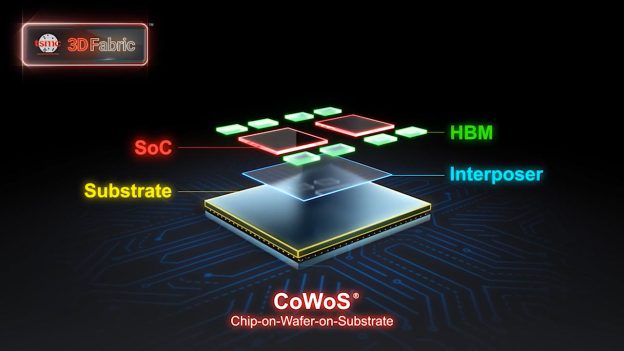

It is worth noting that the yield of NVIDIA’s B200 chips is reportedly below TSMC’s internal standards. Sources cited in the report also suggested that since CoWoS-L involves complex packaging of top-layer chips, interposers, and HBM, TSMC is aiming to make up for the shortfall by increasing capacity. I am doing it.

According to another report in the Commercial Times, TSMC’s CoWoS production capacity will triple as the Tainan facility (AP8), which was previously acquired from Innolux, will begin small-scale production by the end of 2025, and by the end of 2026. It is expected that production will increase to 90,000 wafers per month by then.

read more

(Photo provided by: TSMC)

This article quotes the following information: commercial times and economic newspaper.

Next article

(News) Micron opens HBM facility in Singapore as Samsung and SK Hynix expand investments in advanced packaging