Rockheed Martin (LMT) is in focus as investors’ attention increases ahead of its earnings report. Recent government calls for increased missile production and new contract wins are shaping the company’s outlook this month.

Check out our latest analysis for Lockheed Martin.

Despite recent volatility and large program charges, Lockheed Martin continues to win major defense contracts and government support, which has helped maintain investor confidence. The stock’s momentum is steady, with a five-year shareholder return of just under 49%, so there are modest long-term tailwinds.

If global defense needs are growing and you’re exploring fresh opportunities, consider what else is happening in aerospace and defense and see the complete list with curated picks for free.

The problem for investors is clear as the stock trades near analysts’ targets while Lockheed Martin Book records contracts and faces increased defense demand. Is there any real value left here or is future growth already reflected in the price?

Most popular story: 5.8% overrated

Lockheed Martin’s most followed narrative pin has a fair value of $476.67, just below its last close of $504.49. This puts the stock in the overvalued camp according to general market watchers.

A focus on homeland defense initiatives such as the “Golden Dome,” missile warning networks, and increased ammunition spending suggests future secular increases in the U.S. defense budget and multi-year high-value contract awards. These factors can meaningfully contribute to backlog, revenue visibility, and cash flow stability.

Read the complete story.

Want to see what really supports this price? The story leans toward a strong trio: official budget trends, technology leadership, and a healthy contract pipeline. The full story reveals the numbers behind why so many analysts are focused on a multi-year ramp in earnings and premium multiples. Ready to see which assumptions drive Lockheed’s case?

Result: Fair value (overvalued) of $476.67

Read the full story to understand what’s behind the predictions.

However, permanent program fees and leadership transitions could weaken future profits and create uncertainty regarding Lockheed Martin’s steady growth expectations.

Find out about the key risks to this Lockheed Martin story.

Another view: Discounted cash flow model suggests upside down

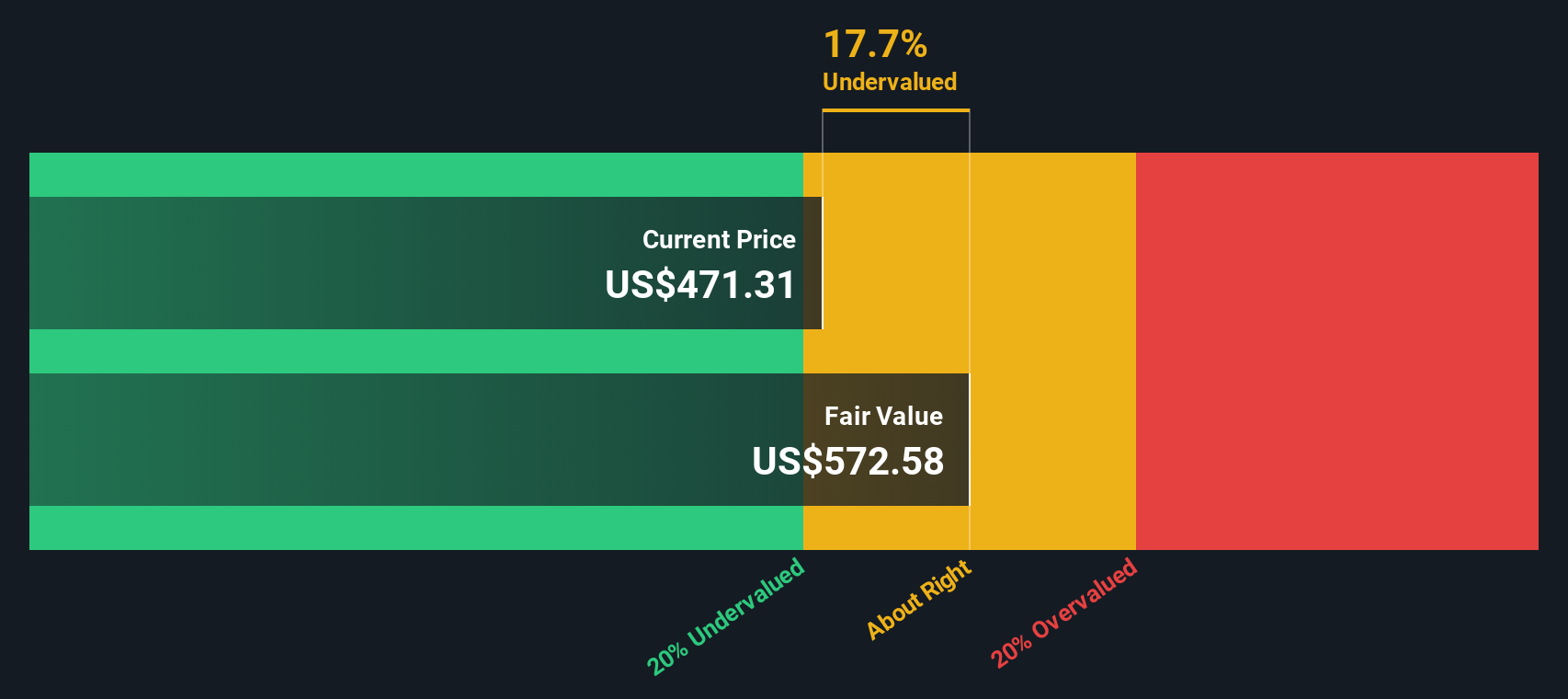

Market watchers believe Lockheed Martin is overvalued by 5.8%, but the DCF model draws a different conclusion. The SWS DCF model suggests that Lockheed stock is undervalued based on the company’s projected cash flows and is valued at $572.45, well above recent prices. That raises the question: Which approach better captures the company’s long-term potential?

Find out how the SWS DCF model arrives at fair value.

Build your own Lockheed Martin story

Prefer to form your own perspective? Dive into your data, challenge the consensus, and create custom Lockheed Martin papers in minutes.

A great starting point for our Lockheed Martin research is our analysis that highlights 3 important rewards and 3 warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop making your next smart move. There is an outstanding inventory of new frontiers with the right tools and insights waiting to be discovered at your fingertips.

This article by Simply Wall Street is general in nature. Our articles are not intended to be financial advice, only providing commentary based on historical data and analyst forecasts and using unbiased methodologies. It does not constitute a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to deliver focused, long-term analysis driven by fundamental data. Note that the analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall ST has no positions in the stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouse (yield over 3%)

• Undervalued small cap with insider buying

•High growth technology and AI companies

Or create your own from over 50 metrics.

Explore for free now

Have feedback on this article? Are you worried about your content? Please contact us directly. Or email us at editorial-team@simplywallst.com