introduction

On January 7, 2025, the Malaysia and Singapore governments entered into the Johor-Singapore Economic Zone (JS-SEZ) agreement during the retreat of Malaysia and Singapore leaders in Malaysia, held in Malaysia. Ta. This groundbreaking event follows the signing of a memorandum concluded between the two governments on January 11, 2024. The JS-SEZ represents the shared vision of both countries to further strengthen economic cooperation by utilizing geographical proximity, economic complementarity, and cross-border use. Synergistic effect.

Malaysia and Singapore are the major trading partners of their respective countries. In 2023, Malaysia was ranked as Singapore’s third largest trading partner, and Singapore was Malaysia’s second largest trading partner. It was an increase of 6.7% from the previous year, totaling USD 785.9 billion.

The longstanding relationships and bilateral relations between the two countries are expected to further improve the cross-border flow of goods and people, and strengthen the business ecosystem of both countries. In this regard, JS-SEZ will allow both countries to tap on complementary value propositions, especially to drive innovation, increase productivity, compete for global investment, and promote economic growth. is expected.

1. JS-SEZ coverage and project targets

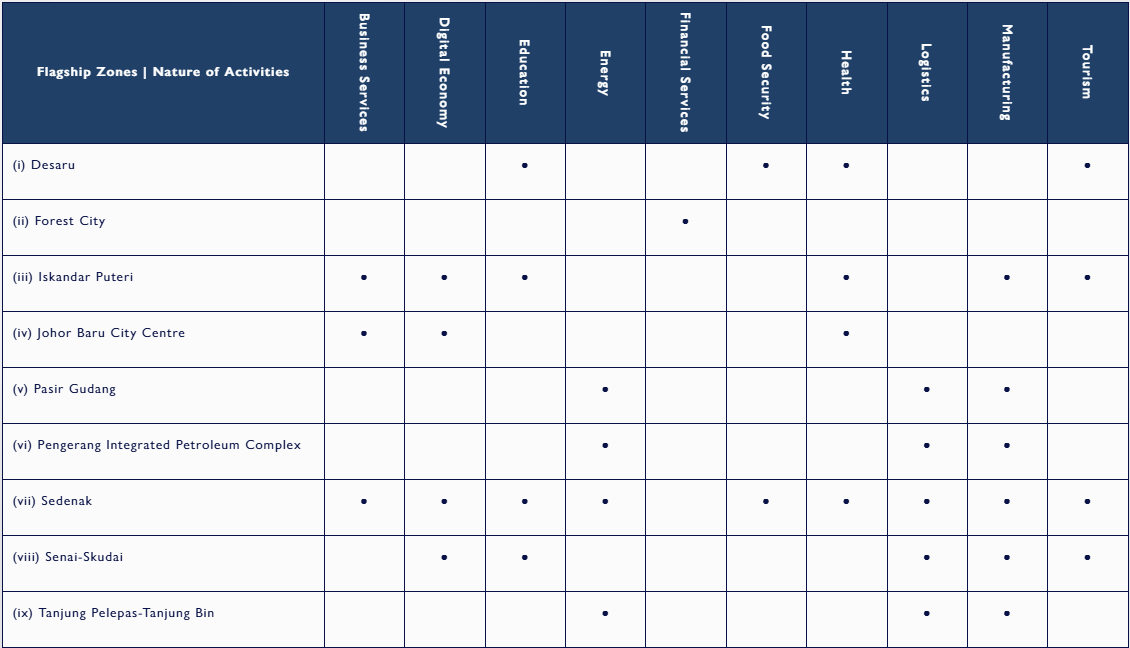

The JS-SEZ occupy 3,571 square kilometres of land (about four times the size of Singapore), and such special economic zones cover nine flagship zones with the nature of activities below:

The Malaysian Economy Minister said the country has 50 new high value projects targets at JS-SEZ over the next five years, with a total of 100 projects continuing over the next ten years.

2. Government incentives

On January 8, 2025, the Johor government and the Malaysian Ministry of Finance will be tax benefits for JS-SEZ, which will be effective from January 1, 2025, to strengthen Malaysia’s competitive situation and promote economic growth. We have announced the measures package. Value investment in Johor. Subject to the details of the flagship zone associated with tax incentives, the prominent terms reported for such incentives are:

Special Corporate Tax Rates: Companies making new investments in qualified manufacturing and service activities, such as artificial intelligence and quantum computing supply chains, medical equipment, aerospace manufacturing, and global service hubs, will be able to reach up to 15 special tax rates of 5. % benefit from the year. Flagship Development Focus: Additional TaylorMade incentives are assigned to companies operating in specific flagship areas of JS-SEZ. Special tax rate for knowledge workers: 15% for 10 years special tax rate for eligible knowledge workers working at JS-SEZ.

3. Other major government support

Some additional important initiatives reported to support the implementation of JS-SEZ are:

Malaysia has established a fund for infrastructure development to promote and promote investment in JS-SEZ, and Singapore will also provide funds to promote investment in JS-SEZ. It has been proposed that Malaysia’s infrastructure development fund will initially be set at 5 billion (approximately USD 1.1 billion), and the size of the fund could increase depending on the return on investment. Centre Johor serves as a one-stop centre that provides consultation services and facilitates the application process for investor approval, and complements the existing advisory services centre of the Malaysian Investment Development Authority (MIDA).

Conclusion

While representing an important milestone in the relationship between Malaysia and Singapore, the establishment of JS-SEZ opens opportunities for foreign companies and investors in certain sectors to operate with JS-SEZ with attractive tax benefits. Strengthening investment and regional economic development. Robust incentives and joint governance sets the JS-SEZ a model for cross-border economic cooperation. Related authorities in both Malaysia and Singapore have indicated that more updates on the JS-SEZ will be released soon.