Some say that volatility, not debt, is the best way to think about risk as an investor, but Warren Buffett famously said, “Volatility is far from synonymous with risk.” Given how dangerous a company is, we always want to consider using debt, as debt overload can lead to doom. Please note that Shaanxi Zhongtian Rocket Technology Co., Ltd (SZSE: 003009) has liabilities on its balance sheet. But the more important question is how much risk does that debt create?

When is debt dangerous?

Debts and other liabilities are dangerous to the business if these obligations cannot be easily met by raising capital at free cash flow or attractive prices. In the worst case scenario, if you can’t pay your creditor, the company can go bankrupt. What happens more frequently, however, is where companies must permanently dilute shareholders and permanently dilute stocks in order to strengthen their balance sheets. . Of course, many companies use their debt to fund growth, but no negative outcomes. When considering the amount of debt your business uses, the first thing to do is look at cash and debt together.

Check out the latest analysis of Shaanxi Zhongtian Rocket Technology

What is Shaanxi Zhongtian Rocket Technology’s debt?

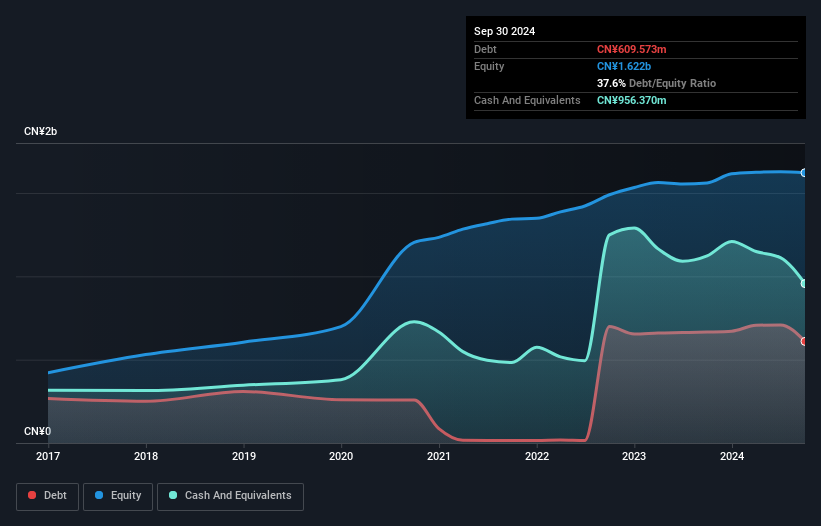

As can be seen below, Shaanxi Zhongtian Rocket Technology was liable for CN 609.6m in September 2024, prior to CN 665.9mA. However, there is also CN 956.4m of cash, which leads to a net cash position of CN 346.8m.

Look at Shaanxi Zhongtian Rocket Technology’s debt

According to the last reported balance sheet, Shaanxi Zhongtian Rocket Technology had a CN of ¥938.9m liability within 12 months and a CN of ¥502.9m liability for more than 12 months. To offset this, accounts receivables that were scheduled within 12 months had CN ¥956.4m and CN ¥634.6m. Therefore, you can show off 149.1m of liquid assets of 149.1m ¥149.1m more than your total liability.

This surplus suggests that Shaanxi Zhongtian Rocket technology has a conservative balance sheet, and could possibly eliminate its debt without much difficulty. Simply put, the fact that Shaanxi Zhongtian Rocket Technology has more cash than debt is definitely a good indication that you can safely manage your debt.

Shaanxi Zhongtian Rocket Technology also warmly notes that EBIT increased by 12% last year, making it easier to carry debt. A balance sheet is the area you focus on when analyzing your debt. But it is more of a future revenue than anything else, and determines the ability of Shaanxi Zhongtian Rocket Technology to maintain a healthy balance sheet in the future. So, if you’re focusing on the future, you can check out this free report showing your analyst profit forecast.

Finally, while tax officers may worship accounting profits, lenders only accept cold, hard cash. Shaanxi Zhongtian Rocket Technology has net cash on its balance sheet, but it looks at its ability to convert revenue into free cash flow before interest and tax (EBIT) and how quickly (or is it eroding) It’s still worth it to help you understand. That cash balance. Over the past three years, Shaanxi Zhongtian Rocket technology has seen considerable negative free cash flow in total. It may be the result of spending for growth, but it puts debt at much more risk.

total

We sympathize with investors who find debt-related liabilities, but it should be noted that Shaanxi Zhongtian Rocket Technology has CN 10.346.8m of net cash, with more current assets than liabilities. In addition, we have increased our EBIT by 12% over the past 12 months. Therefore, there is no problem with using Shaanxi Zhongtian Rocket Technology’s debt. A balance sheet is the area you focus on when analyzing your debt. But ultimately, all companies can include risks that exist outside the balance sheet. To do this, you need to be aware of one warning sign we discovered with Shaanxi Zhongtian Rocket technology.

Once everything is said and done, it can be easier to focus on companies that don’t even need to borrow money. Readers can now access the list of growth stocks with 100% free net debt.

New: Manage all your stock portfolios in one place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

Connect unlimited number of portfolios and check totals in one currency

•Announce new warning signs or risks via email or mobile

•Track the fair value of your inventory

Try our demo portfolio for free

Do you have feedback in this article? Are you worried about the content? Please contact us directly. Alternatively, please email Editorial-Team (at) SimplyWallst.com.

This article simply by Wall Street is inherently common. We provide commentary based on historical data and analyst forecasts, and use impartial methodologies, and our articles are not intended for financial advice. It is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. We aim to deliver long-term intensive analysis driven by basic data. Please note that the analysis may not take into account the latest price-sensitive company announcements and qualitative material. Simply put, the Wall ST has no position in the stock mentioned.