ARM Holdings PLC (NASDAQ: ARM) announced strong profits, but stocks remained stagnant. Our analysis suggests that this may be because shareholders have noticed several things regarding the underlying factors.

Check out the latest analysis from ARM Holdings

Unusual tax situation

It turns out that ARM Holdings received a tax benefit of USD 172 million. It is always a bit noteworthy when a company is paid by a tax officer rather than a tax officer. Receiving tax benefits is clearly a good thing in itself. But the detailed demon is that this kind of profit only affects the year they are reserved, and is often inherently one-off. If tax incentives are likely to not be repeated, then at least without strong growth, you will hope for a lower level of statutory profits.

That may make you wonder what analysts are making in terms of future profitability. Fortunately, you can click here to view an interactive graph showing future profitability based on estimates.

Our view on ARM Holdings’ profit performance

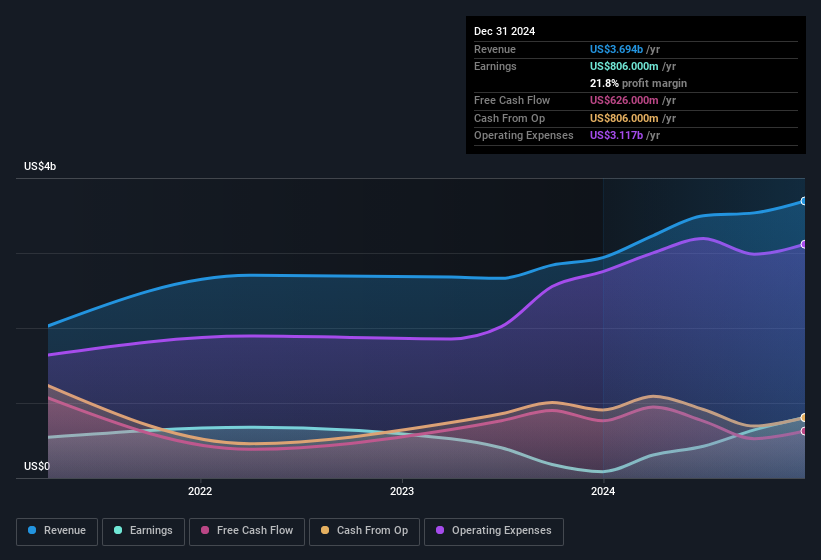

In its final report, ARM Holdings reported that it received tax incentives rather than payment tax. Given that such benefits are not repeated, focusing on statutory profits may make the company look better than it actually is. For this reason, we believe that ARM Holdings’ statutory profits are superior to its underlying profitability. The silver lining is truly amazing, even if it’s not a perfect measure of EPS growth last year. At the end of the day, if you want to understand the company properly, it is essential to consider more than the above factors. Ultimately, this article formed opinions based on historical data. However, it’s also great to think about what analysts are making predictions for the future. At Simply Wall St, you can get an analyst estimate that you can view by clicking here.

Today we zoomed in on a single data point to better understand the nature of ARM Holdings benefits. However, there are many other ways to let you know your opinion about the company. For example, many people view high profit margins as a sign of favorable business economics, while others prefer to “follow money” and look for stocks that insiders are buying. It may take a little research on your behalf, but you will find this company’s collection that boasts free revenues of this free company, or a collection of this company that boasts a list of stocks with important insider holdings It might be.

New: Manage all your stock portfolios in one place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

Connect unlimited number of portfolios and check totals in one currency

•Announce new warning signs or risks via email or mobile

•Track the fair value of your inventory

Try our demo portfolio for free

Do you have feedback in this article? Are you worried about the content? Please contact us directly. Alternatively, please email Editorial-Team (at) SimplyWallst.com.

This article simply by Wall Street is inherently common. We provide commentary based on historical data and analyst forecasts, and use impartial methodologies, and our articles are not intended for financial advice. It is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. We aim to deliver long-term intensive analysis driven by basic data. Please note that the analysis may not take into account the latest price-sensitive company announcements and qualitative material. Simply put, the Wall ST has no position in the stock mentioned.