We recently published a list of 10 AI stocks to watch amid the influence of Deepseek. In this article, we’ll look at where Qualcomm Inc (NASDAQ:QCOM) plays against other AI stocks and sees it amid the impact of DeepSeek.

The launch of Deepseek is drawing out a new battle line in the AI competition, and many analysts believe the technology investment situation is no longer the same again after China’s breakthrough. Speaking to CNBC, Databricks CEO Ali Ghodsi said Deepseek will lead to “distillation” in which it creates smaller, more efficient models based on technology.

“So we’re going to see distillation happening left and right. It’s already happening – as we speak, there are so many versions of Deepseek, which was recreated and redoed last week. So, This distillation only creates a huge amount of competition in the LLM or AI layers.”

It will be interesting to see in the coming days how American AI companies are tackling this challenge and come up with new products and breakthroughs to maintain control.

Also read 7 best stocks to buy in the long term and 8 cheap Jim Kramer stocks to invest

In this article, we have selected 10 AI stocks that are behind the latest news. Each share mentioned the number of investors in the hedge fund. Why are hedge funds interested in the stocks they accumulate? The reason is simple. Our research shows that mimic the top stock picks of the best hedge funds can outperform the market. Quarterly Newsletter’s strategy has chosen 14 small and large caps per quarter, returning 275% since May 2014, breaking the benchmark by 150 percentage points (see more here).

Number of hedge fund investors: 74

Oliver Blanchard of Futurum Group in the latest program on Schwab Network said he likes Qualcomm Inc (NASDAQ: QCOM) as an AI play.

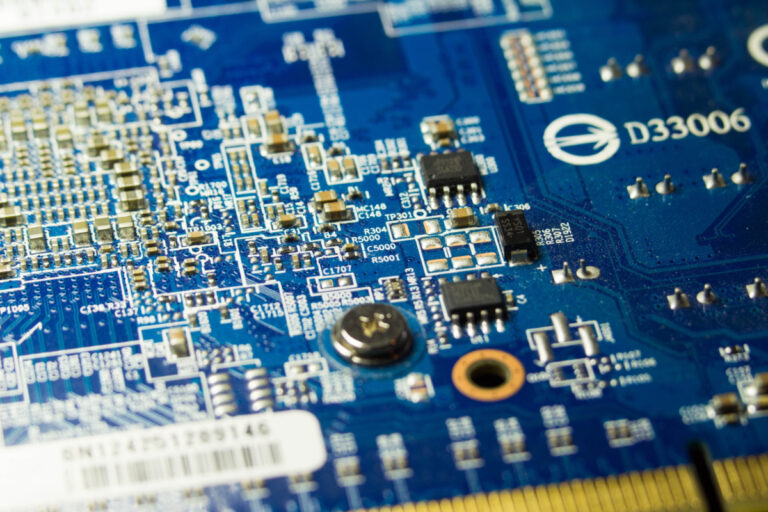

“On the device side, it’s basically edge and device, so the endpoints, it’s mobile, PC, XR, car. I really like Qualcomm. – the power of all these segments, high power AI Chip.”

The Fidelity Dividend Growth Fund said about Qualcomm Incorporated (NASDAQ:QCOM).

“At the stock level, Qualcomm Incorporated (NASDAQ: QCOM) is a major detractor, returning about -14% over the past three months. The company has the company’s semiconductors, software and other products used in mobile phones. It develops and manufactures wireless technology. On July 31, the company reported its second quarter results and issued guidance for the third quarter. Both strongly exceeded expectations. However, the smartphone slower The stock has been sliding due to concerns about the recovery. Furthermore, this quarter has been immersed in the quarter under other semiconductor-related names.”

The story continues