On Saturday, the Trump administration had 25 % of the imports of all imports from Canada and Mexico and collected 10 % of products from China. Many of the fashion industries, like Tactoku’s influencers who denied prohibition a few weeks ago, wanted the threat of tariffs to the end. Unlike Tiku, President Donald Trump, who temporarily waved by the Presidential Order, the tariffs seemed to stay here. Trump said on Friday that Canada, Mexico, or China will not immediately concession to reverses his trade policy.

What does this mean for fashion? According to the U.S. International Trade Commission, China remains the largest apparel source in the United States, but has steadily decreased in the past decade, accounting for 21 % of imports in 2023. Analysts, which are not welcomed, do not overturn the finances of most companies, but add momentum to the long -term movement from China.

Approximately 15 % of the imports of apparel imports have come from the United States, and Mexico has seen the production of clothing from China since Pandemic. But 25 % of tariffs will probably cancel the tendency of nearby. Trump’s short threat of hitting tariffs in Colombia last month will have a similar attenuation effect. Companies will be wary of moving in a factory close to the United States if the economy of the decision can be literally covered overnight.

This week, check how fashion retailers react to tariffs (some major brands have the opportunity to talk about their effects when reporting their profits. Details are as follows). This is just the beginning. Canada, Mexico, and China are expected to retaliate, and Trump has already talked about more tariffs on other trade partners.

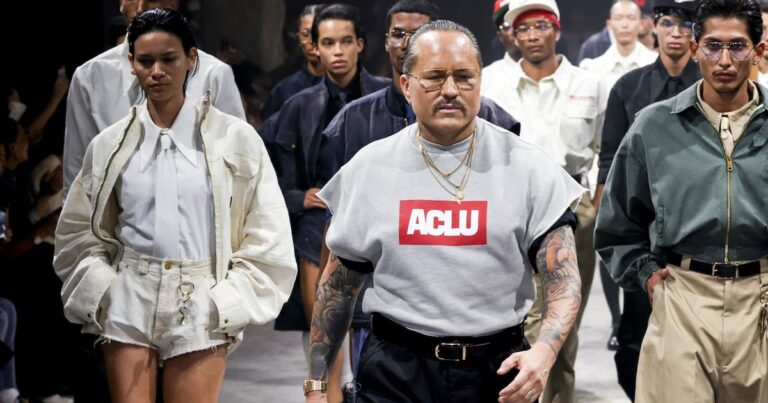

New York Fashion Week

New York’s fashion Week begins on Thursday, and chatting before the season is mainly about who is missing from the schedule. The list includes Pruenza Schuler, which was recently resigned by the founder, and Willie Chabarrian, which was shown in Paris. The latter as the designer told Vogue that it was a “long -term movement” was a special blow for New York, established the week in the place where Chabarria had a recent season, and the waves of the plausible talent. I did.

Christopher John Rogers, another designer in New York, returns to his schedule five years later and has won the famous four -day Slot Chabarrian in September. Tom Brown is also back. The same is true for Todd Snider, Joseph Altuzala and Noma Kamari.

However, Calvin Klein is most commonly seen in Calvin, and will introduce the first collection from Veronica Leoni on February 7. This is a debut of high stakes because the parent company PVH has been working for many years to rehabilitate the brand consumer. Jeremy Allen White’s underwear advertisement was a year ago, but analysts and investors expect to return to growth in 2025 while sales are slow. The ground was handed over when the RAF SIMONS 205W39NYC line was closed seven years ago.

Leoni had a correct experience, stint in Jill Thunder, Celine, Moncler, The Row, and in 2023 she was the finalist of her own brand, Kira’s LVMH Award. Again, Simmons had a more impressive resume, but the brand could not connect what he sent to the runway in New York with Calvin Klein’s mainstream viewers.

Retail revenue

On the other hand, in Wall Street, the retail revenue season has become a high gear, and tapestry, capri, elf, Ralph Lauren, under armor, and sketchers have all reported the quarterly results of holidays. Expect many stories about tariff threats, the slowdown of China’s economic economic and resilience. ELF’s CEO is one of the few people opposing President Donald Trump’s anti -DEI effort, and may appear in the company’s revenue call on Thursday. After the busy start of this year, the transaction will also be an analyst. Do you make sure that Tapestry hunt for a pair of new brands with coaches and Kate Spado after the bidding on Capri? And does Capri confirm the rumors of those Versace? This week you will get a better feeling.

I would like you to contact you in the future! Send hints, proposals, complaints, and compliments to Brian.baskin@businessOffashion.com.