There’s a new multi-trillion dollar AI chip maker in town. The old one still works fine.

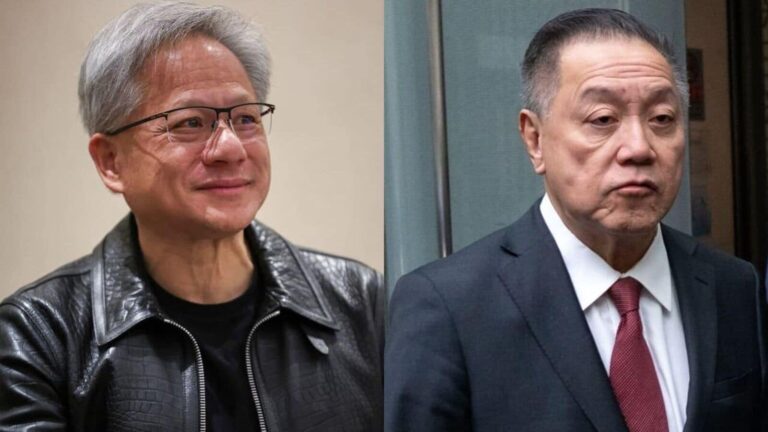

Broadcom’s fiscal fourth quarter report last week included long-term forecasts for its artificial intelligence business, which boosted the company’s stock price and pushed the company’s market capitalization above $1 trillion. It also appears to have done the opposite for Nvidia. The AI chip giant’s stock has fallen about 4% over the past two days, while Broadcom’s stock has soared 38% in that time.

The difference remains large. Nvidia closed Monday with a market cap of about $3.3 trillion, while Broadcom’s market cap was about $1.2 trillion. But Broadcom remains in a tough spot, with its recent rally pushing its stock price to more than 38 times expected earnings for the next four quarters. That’s the highest multiple the stock has ever recorded, and twice the average over the past three years, according to FactSet data. It also marks the first time Broadcom has placed a premium on Nvidia since Nvidia merged with Avago in early 2016, effectively creating the company in its current form. Nvidia stock’s closing price on Monday was about 31 times its expected P/E ratio.

Investors have good reason to be excited about Broadcom’s potential. The company’s diversified chip business gives it exposure to several hot AI markets. Broadcom is a top supplier of networking processors that manage connections between data center components such as chip clusters made by Nvidia. The company is also a key partner for big tech companies like Alphabet Inc.’s Google and Metaplatform, which are designing their own artificial intelligence chips for data centers.

Custom AI chips, also known as ASICs, can run some of the same AI workloads as Nvidia’s products. So Broadcom’s strong outlook last week from typically conservative CEO Hock Tan could be seen as a worrying sign for Nvidia’s own growth potential. In an earnings call with analysts, Tan said that Broadcom’s three major high-tech customers expect to increase 600 in ASIC chips and networking components, the two AI chip markets served by Broadcom, in the fiscal year ending October 2027. It said it is expected to spend between $90 billion and $90 billion.

Broadcom doesn’t expect all that business to be successful. Tan described the figure as the company’s “serviceable addressable market” (SAM), but the comment still comes from the strong $12.2 billion in AI revenue Broadcom reported in its just-ended fiscal year. It was seen as a predictor of growth.

“Assuming Broadcom can achieve even the lower end of the SAM range, we see a path to EPS above $12 by 2027,” said Jefferies’ Blaine Curtis.

Broadcom reported adjusted earnings per share of $4.87 for its most recent fiscal year. Broadcom’s smaller rival Marvell Technology, which makes custom ASIC chips for big tech companies like Amazon, has also experienced explosive growth. Marvell’s total sales are expected to jump 40% in the fiscal year ending in January 2026.

But these homegrown chips don’t fully offset the need for Nvidia’s market-leading silicon. Notably, Google and Amazon, the two tech giants most advanced in chip efforts, both frequently tout their relationships with the king of AI.

“We have a great partnership with Nvidia,” Google CEO Sundar Pichai said during the company’s latest earnings call.

“This is not a zero-sum game,” Bernstein analyst Stacy Rasgon said in an interview. Big tech companies with the resources can design chips that run certain highly specialized workloads more efficiently than chips from outside providers. ” Rasgon said, adding that such chips are inflexible.

He also noted that major customers of cloud services provided by big tech companies don’t want to be tied to a single proprietary computing source. “Enterprise customers all want flexibility, and they’re all writing on CUDA,” he said, referring to Nvidia’s large AI software coding library, which is key to the company’s deep competitive moat.

Therefore, the market still has high expectations for both Nvidia and Broadcom. Most analysts covering both stocks rate both stocks as buys, even though Broadcom’s stock price is above the price targets of most brokerages. Broadcom’s AI business is also only a small part of Nvidia, which reported $98 billion in data center revenue for the 12 months ending in October.

Wall Street expects Nvidia’s data center revenue to more than double over the next two years, but would still be about 10 times Broadcom’s AI revenue forecast for the same time, according to Visible Alpha’s consensus estimate. . Broadcom’s next trillion dollars may not come as easily as the first.

Email Dan Gallagher at dan.gallagher@wsj.com.